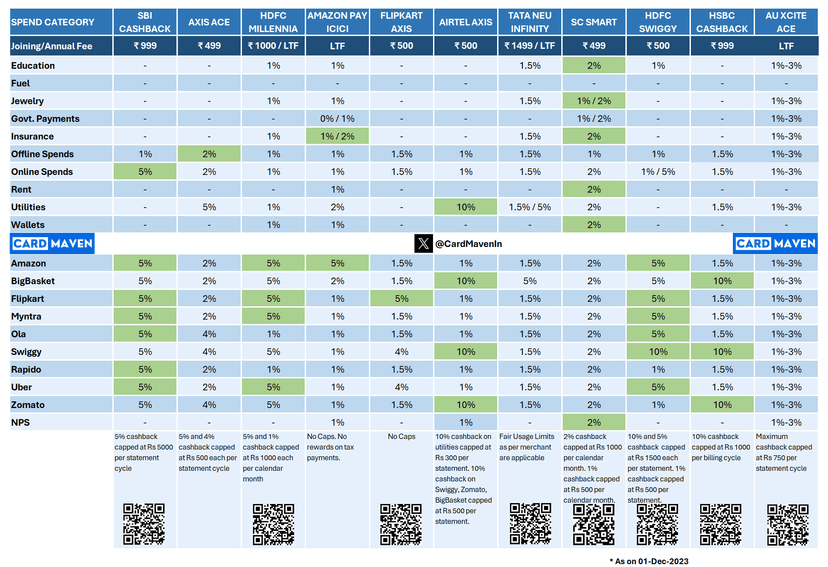

Info on Credit Cards

Anyone here that could help me understand about different credit cards and how to utilise their offers?

Mostly for travel purposes. Thanks!

Thread to discuss credit cards what all basic, specific and premium cards you hold and what are your credit limit on that card.

AXIS (8.55L) - Reserve Vistara Infinite Select

Amex - Gold Charge - No preset limit MRCC PLAT TRAVEL

Hdfc (3L) - Regalia Gold Tata neu Infinity

Indusind - Eazydiner

Kotak - Zen Signature

BoB - Premier Rupay

Pnb - Rupay Select

Icici - Amazon Pay

Amazon Pay ICICI card - 6.2 L ICICI coral - 6.2 L

I Use Amazon pay ICICI card because it gives 5% cashback on Amazon and 1% of all other transactions

Hey man have you got any idea how the limit for your Amazon pay card increased? I use it regularly but I am still capped at 1 L.

Initially my limit was 60 K as my salary was 30k , I used it regularly then it got increased to 1L , I switched job now my salary is 1L and kept using the card so now it's 6.2 L .

Whenever you are eligible for increased limit you get a msg informing you that you can increase your limit by replying to the message

HDFC Ragalia - 11L HDFC Tata Neu Infinity - 11L Axis Ace - 2.9L Amex MRCC - 3.2L Amazon ICICI - 5L

ICICI (Amazon Pay) - 5.1L Axis (Ace) - 3.3L SBI (Cashback) - 1L HDFC (Moneyback+) - 75K

I use ICICI Amazon Pay Card for amazon exclusive payments. SBI Cashback Card for anything online other than amazon. Axis Bank Ace Card for bill payments & anything offline since it offers 2% on offline transactions. And, I have kept HDFC one since I got it lifetime free, and use it when there are discounts for HDFC Credit Cards in Flipkart/Amazon sales (usually around Big Billions)

Why not SBI Cashback on Amazon as well?

Amazon ICICI card gives cashback as Amazon Pay balance. While SBI gives back in credit card payment itself, which is much better imo.

Good point. There's a few reasons:

Amazon Pay Credit Card was my first credit card, and hence has the longest credit history. So, there was no point in closing it after getting the Cashback Credit Card (as it being the latest one for me).

Cashback Credit Card has almost 1/5th the limit of my Amazon Card. Hence, I like utilising the Amazon one as much as I can before I can stress the Cashback one. I dont want either of my cards to have spends >20% of the available limit.

If there is a sale on Amazon (like Prime Day), if there is 10% discount on SBI Credit Cards, Cashback Card is always excluded from it. But, Amazon Card is usually offered the benefit with 5% Discount + 5% Cashback.

I honestly feel that Cashback Card will be nerfed in future (I mean, it was already nerfed a few weeks back), but its still too good to be true.

ICICI Coral - 5.9L HDFC Millennia - 2.5L SBI Cashback - 1.25L Mainly use HDFC and SBI for online purchases and rewards

HDFC Infinia - 13L Only one card

Any specific criteria to get offered Infinia? I am stuck at Regalia gold

Following

Recently ordered an Axis Magnus but then the devaluation happened, now cancelled it and looking for an alt :(

Use only one - Infinia - 12L limit

HDFC Regalia - 3L HDFC Rupay UPI - 3L ICICI Rubyx - 5.6L ICICI Amazon Pay - 5.6L

Is regalia useful? I am offered it by the bank

I use it mainly for the lounge access and when Dineout used to be a thing before Swiggy took over. Also you tie one of your utilities with SmartPay for auto bill payment on a monthly basis and it becomes free without having to pay the annual fee from the second year without any minimum spending requirment to be met. SmartBuy too seems to be having some really good offers but I haven't explored it fully using my Regalia.

Anyone here that could help me understand about different credit cards and how to utilise their offers?

Mostly for travel purposes. Thanks!

Thread to discuss bank accounts , type of the account and what do you use it for ?

What all cards do you use? Which one is your favourite? Which you are thinking of applying and why? Let's discuss this in the comments.

I use HDFC Millenia & HDFC Tata Neu Infinity

Suggest good credit cards which you are personally using. Both which are free & have annual charges.

Do mention which use case it is best for: -online spends -offline spends -foreign transaction -fuel spends