will I get itr refund?

my new company is asking for investment proofs for tax now only, I'm yet to invest in elss. If I don't provide the proofs I'll be paying more tax but I invest in elss in between Jan to Mar, I can show this while filing and claim a refund right? please help here.

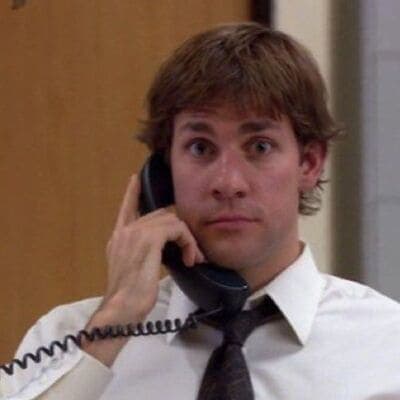

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

why don't you start investing from April? Any reason to invest only in jan to march ?

Cuz financial year ends in March? Shouldn't all investments for that year be made till March?

you can. Any specific reason to do in jan-March?

Any benefits doing in such way ? Just to learn about that

Yeah, but I will say if your are thinking of ELSS do a SIP.

Makes you disciplined and consistent investor, will help in long term and you don't have to worry of these things too.

Agree, don’t do ELSS only for tax saving purposes, it is a good investment avenue to do an SIP

Agree

Yes buddy

Yes.

Or else what you can do is change your regime to new regime during ITR filing. It will give you refund of the excess TDS collected by your company

Not an option since I already have enough investment proofs to reduce tax considerably using the old regime

If it is a scheduled investment, then some HR teams will allow if you show them last year investment and prove that same amount will be invested this year also. If this is not possible then you can claim refund at the time of filing returns