CosmicTaco

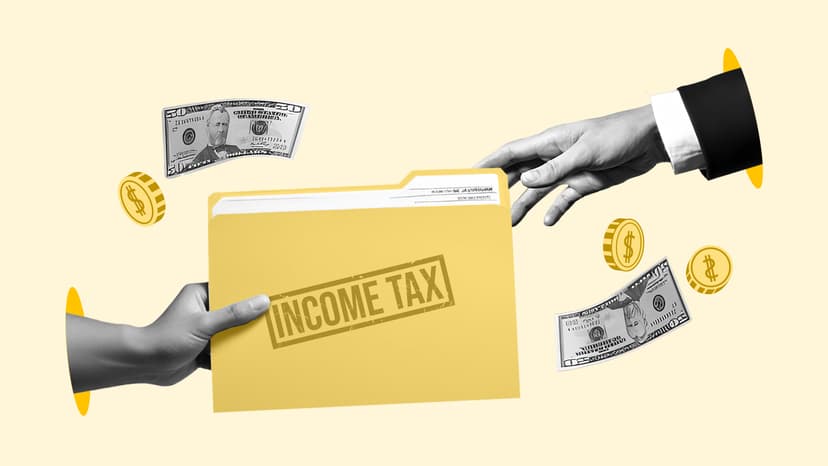

Tax Rebate Hike: Zero Tax Up to Rs 12 Lakh

- The Finance Minister announced a hike in tax rebate under Section 87A, allowing zero tax for resident individuals with net taxable income up to Rs 12 lakh.

- Salaried individuals with a standard deduction benefit of Rs 75,000 will pay zero tax if their gross taxable income does not exceed Rs 12.75 lakh.

- New tax slabs introduced: 30% tax starts at Rs 24 lakh, and a 25% tax rate for incomes between Rs 20-24 lakh.

Source: The Economic Times, The Economic Times, The Economic Times, The Economic Times

10mo ago

Jobs

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑+322 new users this month

SleepyLlama

Zepto10mo

New Regime

4-8lac- 5% tax = 20k

8-12lac- 10% tax = 40k

12-16lac- 15% tax = 60k

16-20lac- 20% tax = 80k

20-24lac- 25% tax = 100k

Total tax till 24 = 3lac

Old regime 2.5-5lac- 5% tax = 12.5k 5-10lac- 10% tax = 1lac 10-24lac- 30% tax = 20k

5.32lac tax till 24lac

Post 24lac its same 30% in both

GoofyCupcake

Walmart10mo

It will be 482500 for old tax regime. Your calculation is wrong it should be 12.5k + 50k + 4.2 lakh

SqueakyNarwhal

Capgemini10mo

In this tax regime.

The tax is applicable on total ctc or gross salary

GoofyMochi

Nice

Discover more

Curated from across