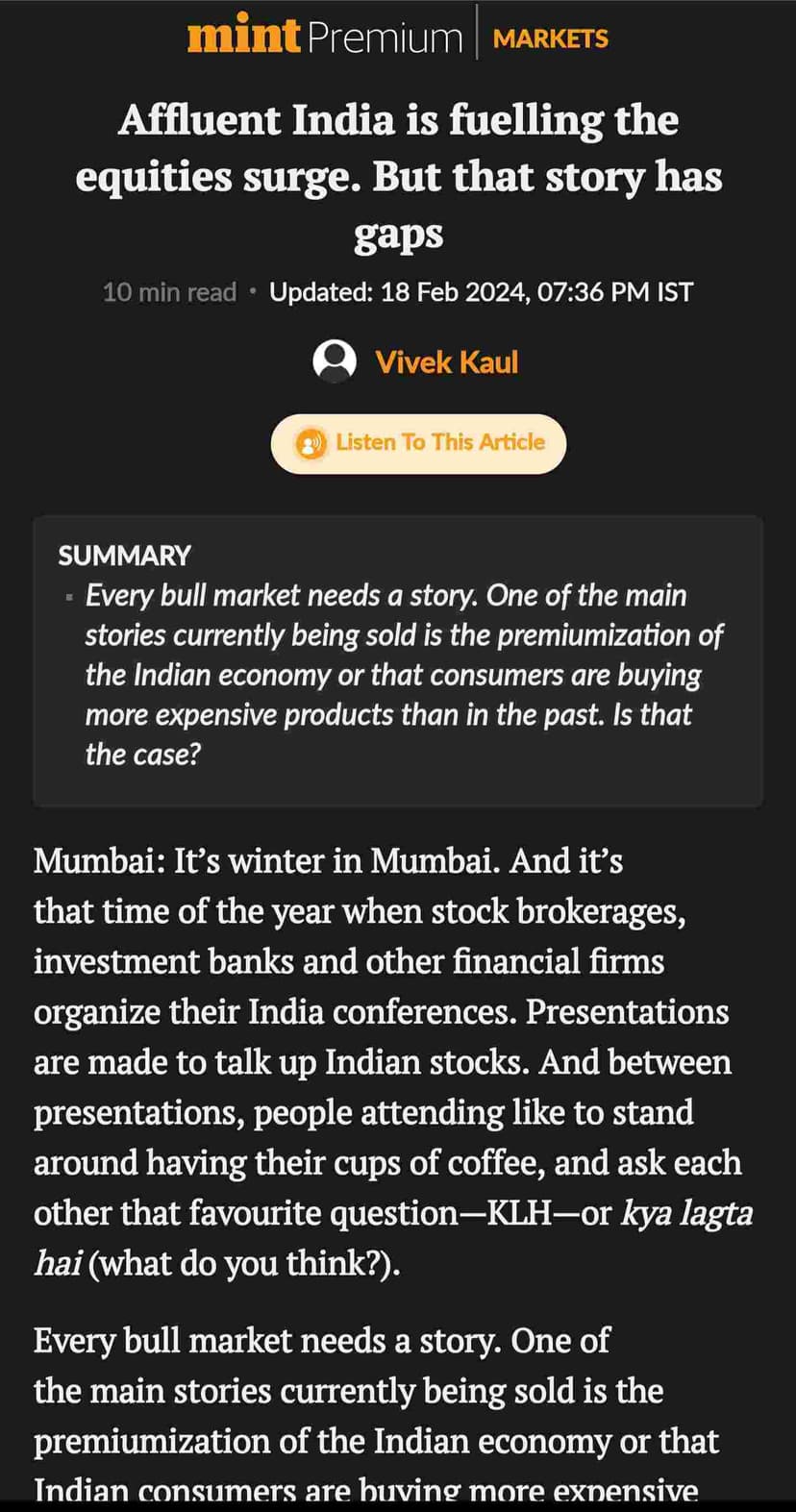

India Predicted to be Fastest Growing Major Economy

- Former US treasury secretary Larry Summers predicts India will be the 'most rapidly growing major economy' over the next few years.

- Summers is optimistic about a six-fold jump in India's GDP by 2047, crediting Prime Minister ...