For fmv you have to ask company itself.

Example

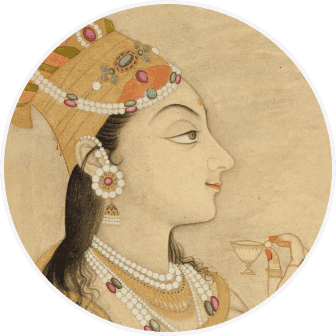

If exercise price: 1 rupees

Fair market value : 10 rupees

during exercise you get 10 rupees share if you pay 1 rupees thus your profit is 9 rupees. You also have to pay perquisite tax on 9 rupees profit(Look it up for more info)

Above scenario depends on whether company allows you to exercise or not. Unless company is going public you won't be able to exercise the stocks. But sometimes company does buy back which allows you to exit.

Ask your HR : when can you exercise your options? Has the company ever done a buyback? Is there a planned one in future?