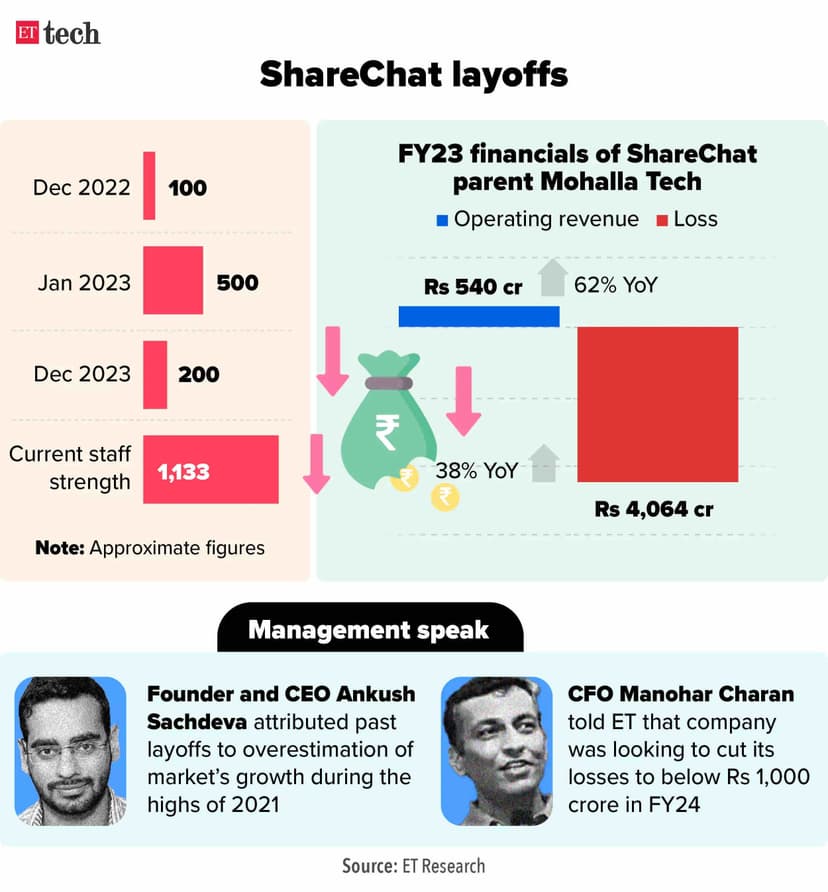

Sharechat 3rd layoff

ShareChat’s 62% increase in revenue for FY23, at Rs 540 crore. However, its losses widened 38% to Rs 4,064 crore

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

9 to 1 ratio of spend to revenue, raised $1.4 billion to date and is eight years old. There is nothing about this asset which is worth a growth investor's underwriting.

India is not even vaguely close to being a market for social media products within the consumer internet space. We do not have the consumer behaviour that other markets do and there is nothing wrong with it. Meta, Snap, Instagram, WA, Telegram, Discord etc are all great examples with a base in India, but negligible revenues barring Meta which is 8-9% of their topline on a TTM basis.

Sharechat is an ideal example of building a product that no one wants to pay for. Co founders exiting, layoffs and write downs are all to be expected.

Well said

Most of their costs would be server costs which probably wouldn’t come down, tech costs can be reduced to only some extent. They need to bring revenue not reduce costs!! And for revenue, they are competing against IG/YT which has junta that can spend. I think while incepting the company, they forgot “tier 2” population won’t bring money.

These guys layoff as if it’s just a metric and not real humans behind them

Such pitiful numbers.

In 5 years this company will be shut. As AI takes over content creation

How did they make a loss of 4064 crore?