Salary account or Savings account?

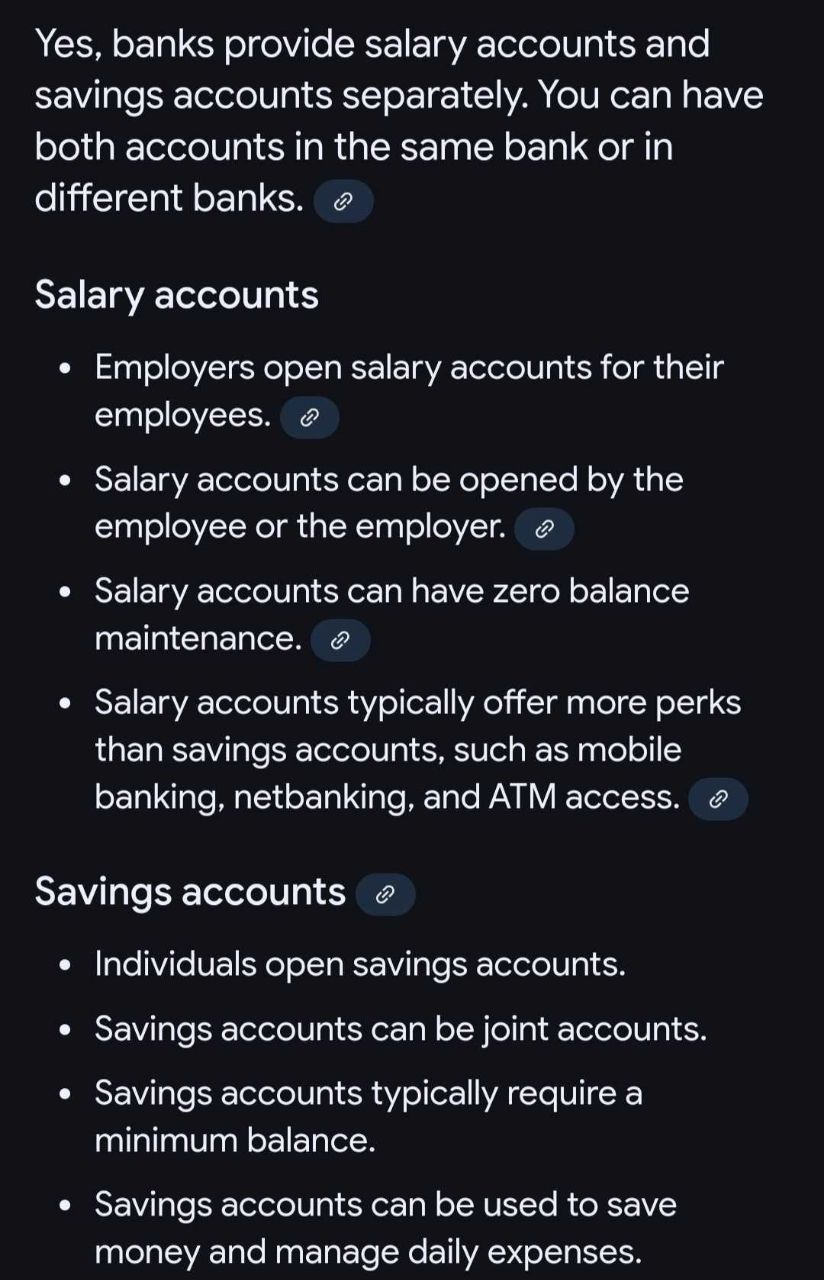

Hi folks I am failing to understand what is the advantage of talking Salary account. Even the thing about maintaining zero balance doesnt convince me. Recently I visited Axis bank and i was told I have to maintain 25k min balance or transact minimum 25k to avoid penalty. So lets say I have only 25k in my account and I took it out ,it counts as a transaction and I wont have to pay penalty right? Then whats the point.

If interest rates is the difference I want to know how significant it is and any other benefits ,which one is suggested for a salaried employee

Thanks in advance

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

You can’t choose not to have Salary Account, will you not get any Salary? Salary Account is just a Saving Account where your salary gets credited. It comes with just one benefit in most cases that you can keep zero amount (I mean you can withdraw/debit entire salary on day1 itself, keeping zero amount). So your post is not clear. There is no choice between Salary and Saving Account.