Roast me on savings made till date

Short built up .

YOE 10 CTC Base : 33 ( it's below gv standards ) Debt free no emi .

Need suggestions to grow at least 10x in upcoming 10 years .

Monthly expense : 25 k frugal lifestyle. Corpus remaining: 150 k permonth

Married no kids .

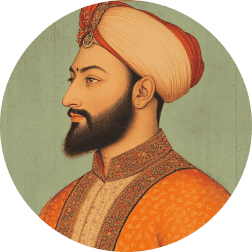

Savings till date asper snip attached 1.27 cr

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

I hope you don’t have not maid your real estate purchases in the bubble (2021-2024) in bangalore, if yes then you are screwed for next 10 years my friend.

1 st flat purchase 2013 2 bhk

2 nd flat purchase 2021 1.5 bhk

Yes and it's not in Bangalore .

Nice 👌🏻, your real estate investments are good then . all the best.

Try adding more money to mutual funds vis sips as they are more liquid.

Debt free is the best bit. If u are planning to upgrade ur lifestyle then start investing in urself and make couple of job switch. No other way to accelerate growth

Noted

Any particular reason for the majority of investment being in real estate?

It happened that way .

Real estate is limited and stable as compared to other options also in long run wanted to own house and stable rental income . Which I achieved .

What is the rental income? Ur getting

You need more liquidity.

Having some 2 L emergency liquid stored is not mentioned here .

Help me brain storm to grow more in right direction.

How much save is giving mail read permission to any app? Like in your case for NPS

Didn't gave that thought.

Nps is by default locked for time I turn 60 .

Still your concern is right .

Yeah so I recently invested in NPS first time and had been using INDmoney for a while but NPS tracking requires mails read permission 🥺

I think I was in a similar situation 5-6 years ago but with debt on housing. I aggressively added equities in all with major allocations to index in MFs and large caps. I felt that I might have a better understanding of tech and started investing in US tech stocks. Sadly, I’m just about double the number you have with real estate being half of it.

My hope is on ESOPs converting to liquidity when they IPO in 3-4 years. Hopefully, that’ll double my networth once again. So, I guess, you could say that I’d reach 5-6x of this in the next 3-4 years.

What you’re aiming for in 10 years with a conservative outlook on equities as per your comment seems a bit unrealistic unless you make major moves.

Not sure how long you will be able to keep up the frugal lifestyle. Lifestyle inflation is something you should account for especially since you’re married and probably would have kids. So, better to contact a FPA for advice? 30-35k leke they might be able to help. I think INDmoney also has some on demand advice feature. Try that if it exists.

Why didn't you aim at being debt free first .

Instead of going for equities anything specific.

Looking good so far but its on the lower side for decade+ yoe I guess, you can afford to increase risk appetite by selling one flat and dumping money in some stock for the long-ish term.

How do you tackle volatility and market dynamics .

By doing a purchase-and-forget.

Daily checking prices almost always ends up with a deteriorated (and often demented) mindspace.

Been there.

So now, its about making few bets and checking back on them after 6months, 1y, 2y

Your portfolio is constipated to say the least.

Suggestions bro .

What do you suggest to diversify

Real estate chunk was planned to have real things in hand . Market dynamics make me uneasy and it seems to be more manipulative by bigger players and game is rigged .

I want to play to win .

Which app are you using?

Ind money