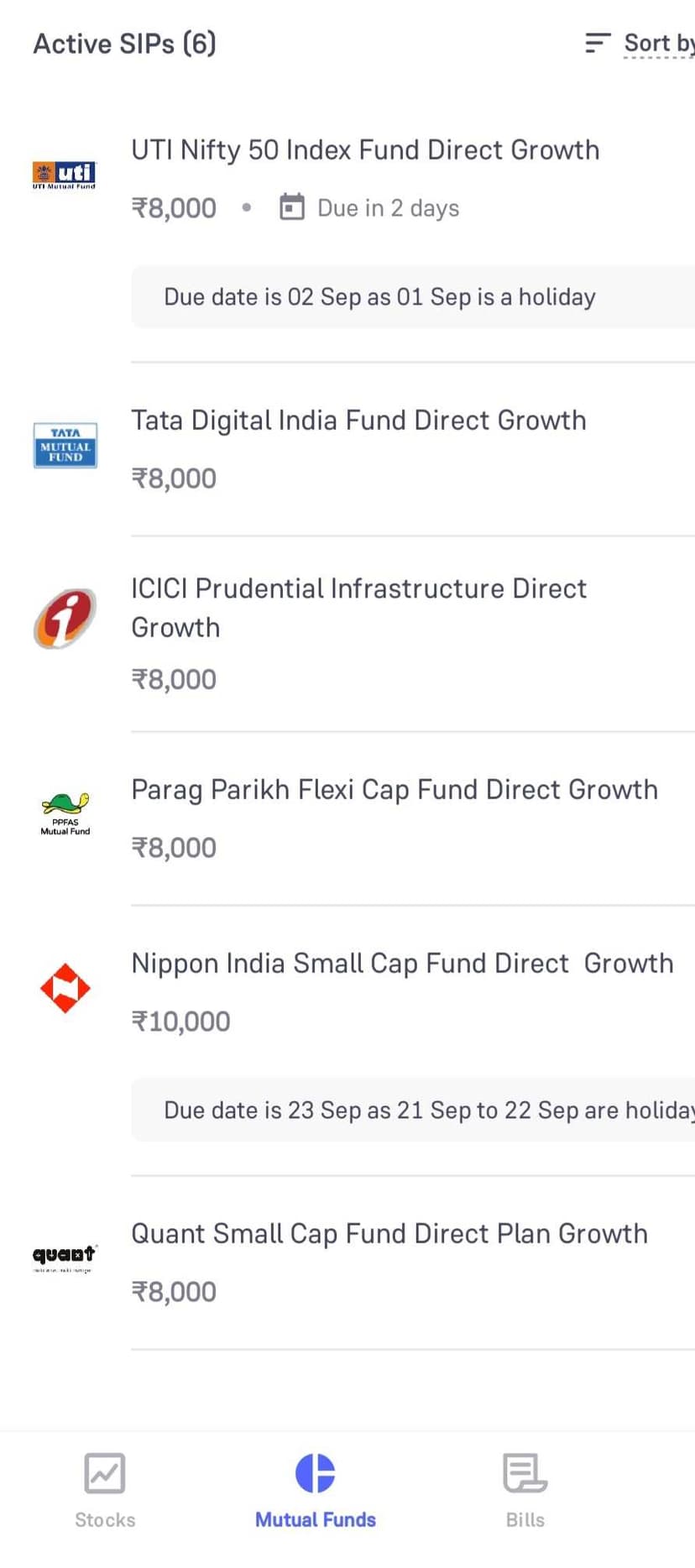

Review my Mutual Fund SIP Portfolio

Can someone review my SIP portfolio? I am attaching my all the active SIPs picture below. I'm 26 years old and I belong to economically poor class family ( I started working 2 - 3 years ago so now my family's economic condition is somewhat better)

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Not an expert here, but doing sip from last ~7 years.

Your portfolio is slightly on the riskier side, as you have 2 small cap and 2 thematic funds,

Also there is no mid cap fund, maybe give it a thought

Any particular reason for choosing so many different MFs? Just asking as I am also about to start SIP soon

Diversification!

Yes, just to diversify my portfolio, I want to invest for a long time (20 years)

I would personally remove both thematic funds and go with mid cap, and remove 1 small cap and go with bluechip prolly mirae bluechip(large and mid cap now) or canara or axis

Honestly I like this mix. Just keep at it for 10years. Just see if you want to revisit the overall approach and invest in lumpsum in 1 fund in a particular month and the other ones next month. Might be tricky , may yield a few extra % returns annually.

Good aggression in fund selection!

Good luck!

can add sensex index fund, although i believe there must be an overlap with your current funds.