Reached a net debt of 180k Rupees at the age of 25 .

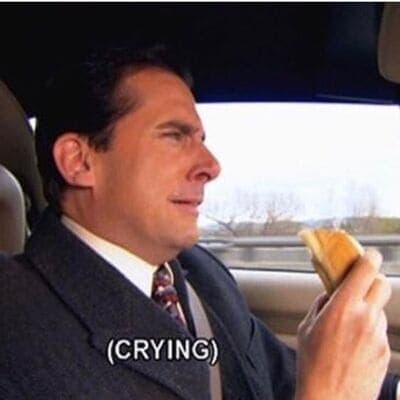

My current salary is 4.1 LPA with 3 years of experience in IT. I reached a net debt of 180k Rupees at the age of 25 .The best part is I don't think I hit the rock bottom yet. I feel like my worst is yet to come.

Although ,I have a debt of more than 1/3rd of my early salary with out cuts , I chill all other days except on the day of credit card bill payment or the days where my father asks me to help him out with some money. I never say no to him and I go into further debt , but I never regret giving my father my money and never should be.

Coming back to the topic , I don't know how I forget how broke I am until the day comes where I have to pay my bills. Where do I get this courage to eat all the rubbish outside and spend like i earn in lakhs every month?

I don't know how I've turned into such a demotivated and lethargic sloth.

I am feeling all this right now , but i am sure that in two days of time I will forget all these feelings I feel now and enjoy life as if I have 2 crores in my bank account.

Cheers to being shameless.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

In my opinion, you should think of switching company who will pay you in lakhs. Software engineer with 3 years of experience are earning 1.5 lakh per month. Study hard and crack a interview in a solid company. You will be out of debt in just 1 pay cheque. Think of coming out of this debt trap Asap. Meanwhile, convince your parents to limit their expenses for 4-5 months so you can prepare with free mindset. Goodluck!

Thanks for these tips mate. My current technology is informatica and it is almost dead , I have to make a technology switch to get a good package. Any recommendations?

Married, combined salary= 130k/month. Two personal loan emi. Total emi= 58K. Total loan amt = 40lakh (including my father’s which i have to repay).

Currently searching for a better salary. Keep going…

Better to know other side before commenting such.

You need a routine... one routine and one discipline and for the rest day you can be as much lazy or shameless as you want but one routine (like workout for an hour) and one discipline like 'Will have one healthy meal a day!' Or 'Will put in 1 hour everyday upskilling'. Start with this... and scale up when you feel like levelling up. Posting here shouldn't be the last thing you do.

Working on it for the past 3 days , I hope I will carry on the same form this time around. Thanks.

Iam not sure if it helps but when we were using credit cards like nothing we were always in debt .so my husband and myself decided to close everything. all credit cards were closed and deactivated . Simpl / paylayers / lazypay all accounts deleted .we did took hand loan to close everything but got them cleared in next month . This was the best decision we took and considered spending with only cash on hand .

Now we are out of debts no unnecessary spends and happy no bills to close . You should surely do that and see how relaxed and happy you will be .

I salute your resilience and commitment to be able to do that. I'll try and explore this option . Thank you for sharing

- You need to switch as soon as possible to a job with atleast double your salary and it's possible with your current package with higher chances.

- You need to make a strict pattern of not spending the money however you want, otherwise it won't take time to convert this 180k to 1800k or 18L in a year regardless of how much you earn.

- You are stuck in a debt track now and maybe you need a year atleast with the current salary to clear it off.

- Credit card debt trap is the worst as you would have to pay compound interest monthly. 3% monthly compounds to 42.5% annually is a misconception. The reason is you aren't considering 18% GST on the interest and it compounds to 51.8% annually.

- If you are paying just the minimum due, you are never gonna get out of this debt trap. So please pay as much money as you can in the beginning itself and be a miser the rest of the month.

- If possible, try to convert this whole amount into EMIs as it would lead to a minimum due of (180k+interest as applicable)/(no of EMIs to pay).

I am not criticizing you, I am just mentioning these points so that you can get out of this damn trap as I was once in this and severely burdened financially.

Thanks for all the tips brother. I refrain from minimum pay . I pay the full amount all the time even if it means that I have to pull the amount from other credit cards but I know down the line the processing fee is gonna add up to a lot. And I have already gone through the path of converting to EMI but that's gonna incur me a lot in interest. The only plausible solution is to switch companies and earn more. Which is with all the motivation i got from this thread seems possible now.

Sure Brother.

I wish you all the best and hope you are outta this trap soon.

I'm in the same situation the only thing is I'm earning 2 lakhs per month

Then you are not in the same situation 😂

Cheers

Can relate totally, if I can accumulate all the expenses I did on Zomato/swiggy alone where I could have easily had homemade dinner, the expense could easily go above 2L lol. It is indeed a guilty pleasure. Just spend wisely brother.

Woah!! My man you are the face of the foodie community. Thanks for sharing. Cheers

Switching and earning more are the only options.