₹70K Tax vs ₹1.7K Tax: How Higher Basic Pay & NPS Supercharge Your Salary

A friend with 3 years experience just moved from TCS (basic ₹16,000/month) to Cognizant (basic ₹39,525/month) on a ₹14,00,004 CTC, and the difference is massive.

Check the chart: with NPS, he pays just ₹1,753 in annual tax. Without NPS, the tax shoots up to ₹70,812! That’s money you could save for your future instead of giving it away in taxes.

At Cognizant, higher basic pay means bigger retirement savings and more employer NPS contribution. TCS and similar companies keep basic pay low, so you lose out on tax benefits and pension growth. Your take-home might look similar, but your long-term wealth is not!

Don’t settle for low basic. Choose companies that care about your future, opt for NPS, and make your salary work for you-not the taxman. 💡💰 #SmartSalary #NPS #TaxSavings #CareerGrowth

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

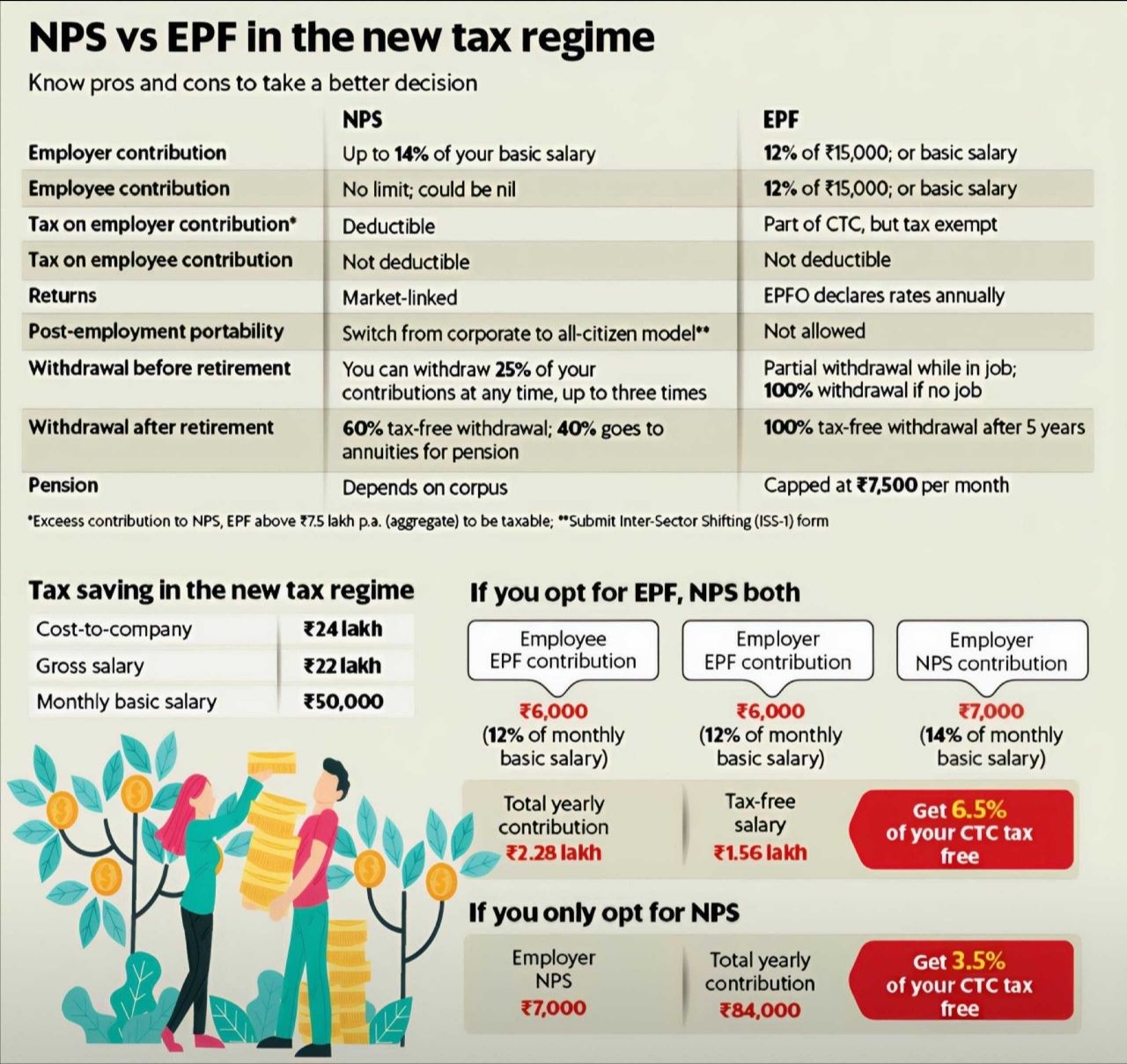

This must be for new regime? But NPS contribution is not allowed for tax rebate in new regime. How come it can make a difference in tax?

Yes this is for new regime.. And only exemption salaried has is this 14% of employer contribution to NPS

You should ask your employer and share your pran and ask them to include NPS in your ctc. They will make changes.. Then it'll be employer contribution to NPS and hence tax saving

So i have epf or nps ? What is nps basically ? Like epf we can withdraw , what about nps , and in pf both employee and employer contribution we only give what about nps

NPS is a voluntary retirement scheme where your company can contribute up to 14% of your basic + DA under the new tax regime (Section 80CCD(2))-that employer contribution is deductible, lowering your taxable income. Employee NPS contributions don’t reduce your tax under 115BAC, but you still build a larger retirement corpus. Returns aren’t fixed; they’re market-linked (equity, corporate bonds, government securities) and have averaged 9–12% p.a. historically, much like mutual fund units.

On your payslip/CTC, employer NPS will appear as its own line item (you’ll see “Employer Contribution to NPS”) instead of allowances.

Here are three single-line pros and cons with average return:

✔ Tax benefit: Employer NPS up to 14% of basic + DA is deductible under Section 80CCD(2).

✔ Higher returns: Market-linked NPS returns ~9–12% p.a. vs fixed-rate EPF ~8.15%.

✖ Limited liquidity: Only upto 60% lump sum is tax-free at retirement; remaining 40% must be annuitized as pension, reducing flexibility.

How is VPF different from EPF and NPS ?