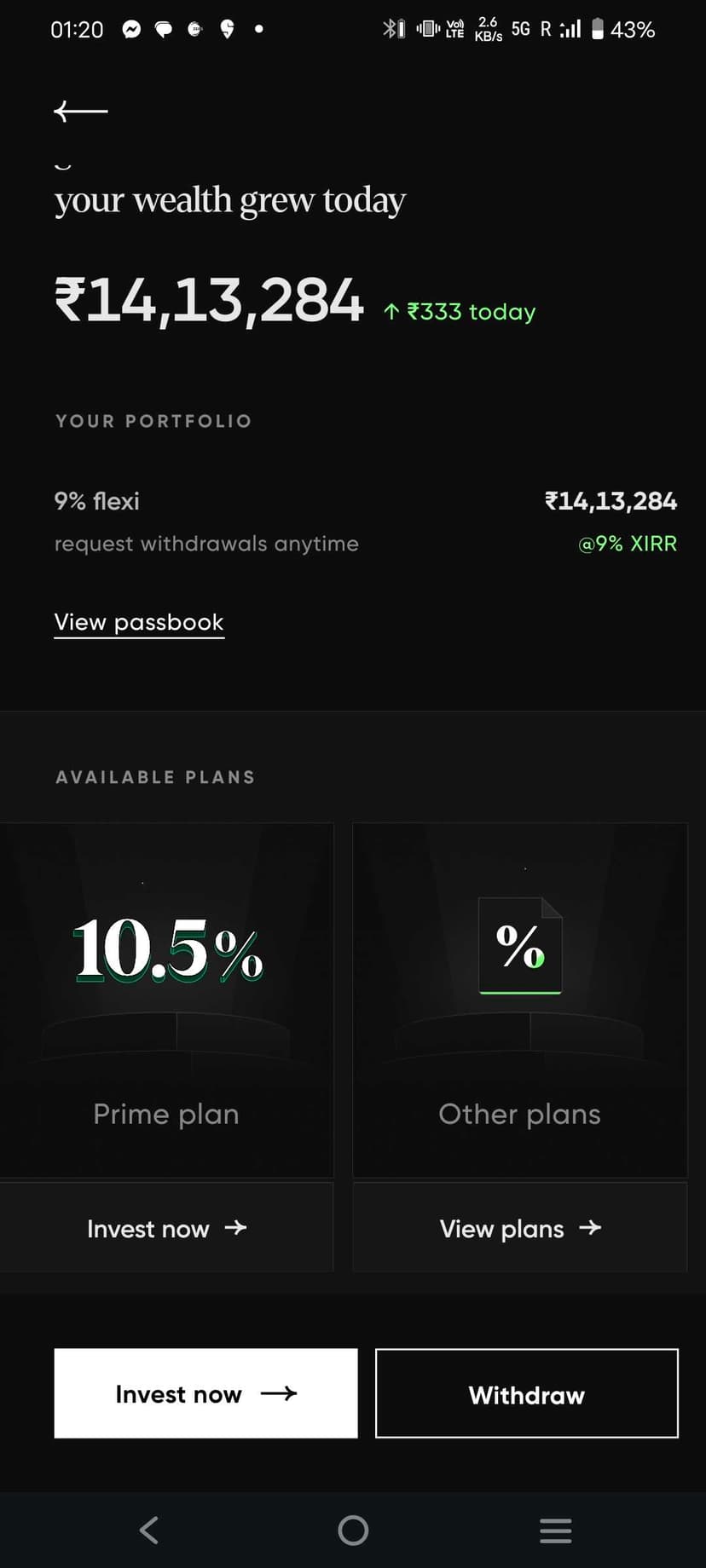

P2P lending diversification

I have put lots of my liquid money into P2P lending and get 1k daily from cred mint, mobikwik xtra and 12%.

Reason- My bank pays interest which hardly can beat inflation.

Question - Where should I park my liquid money ?

PS - Markets at high and real estate is bound to crash.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

are you sure real estate will crash ? Any lead indicators ? Can you say more about this..

I don’t think real estate will crash. When market reaches such highs, there comes a time when people believe it’s not worth investing at these levels and they look for alternate places to invest. I expect real estate and gold prices to go up because of the same

So here I go.

Top 5% of Indian drive real estate consumption.

After rera n GST, Black money guys in real estate has reduced.

With onset of AI and Developed economy going into technical recession...we can see an impact on Indian job market.

As ai strengthen, more people will be replaceable.

Most of the loan has tenure of 10-20y.

So they will default and a crash.

Google about China and usa housing crisis.

check out Checkout this post on Grapevine - https://share.gvine.app/G5e8rHUiEfN43TNp7

P2P Lending firms self regulating to stop instant withdrawals from 1-Apr

I sincerely hope you have >5 cr in investable corpus. 14L is not safe if not. Please speak to a financial advisor.