My Investment Portfolio & Curious Questions 🧐💸

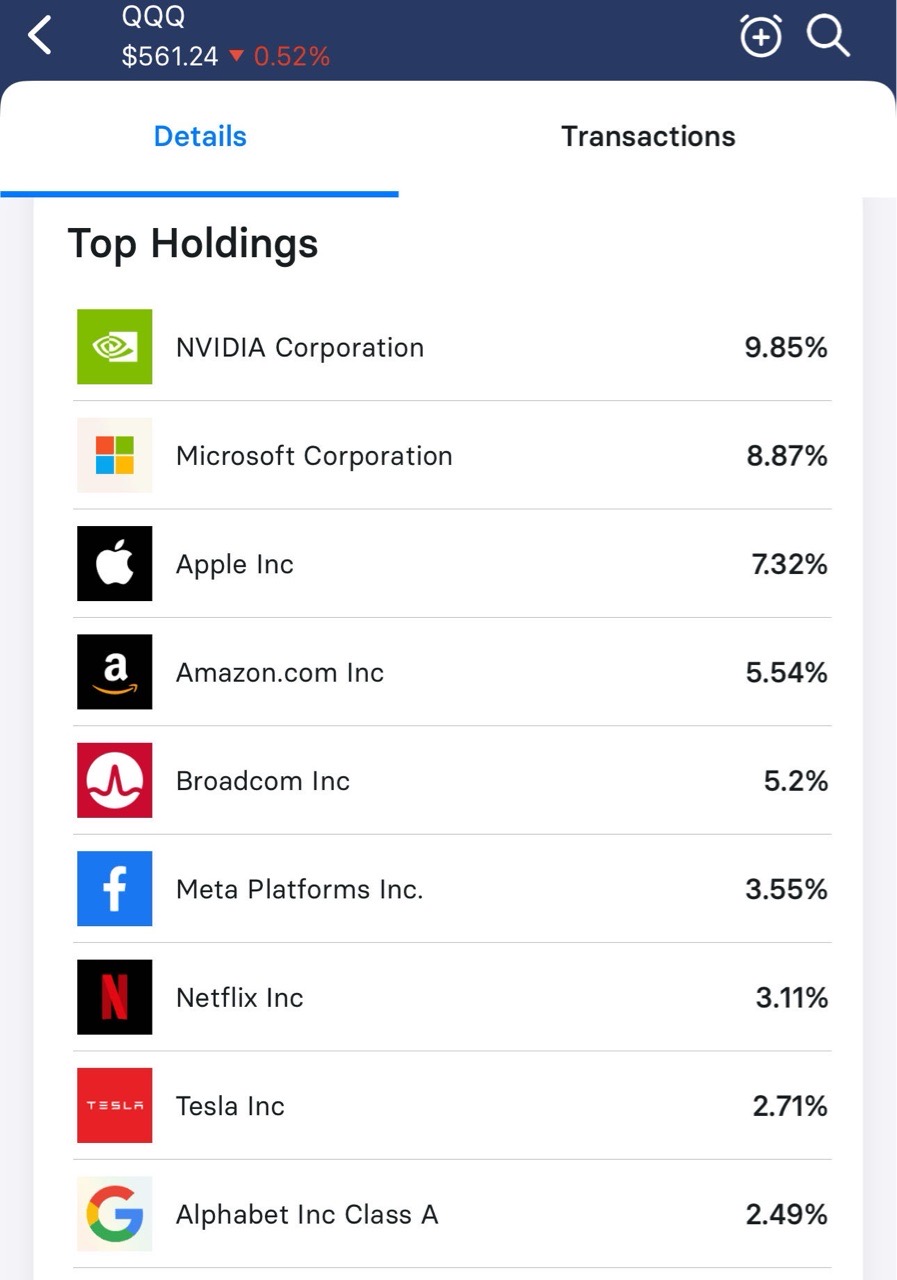

Hey there! Below are snapshots of my current investment jungle—ranging from US stocks to SIPs and mutual funds. Here’s how my money is currently doing the cha-cha: • A. SIP in Invesco Mutual Fund: ₹5,000/month – slow and steady! • B. SIPs in Nippon & Parag Parikh MFs: ₹5,000/month in each – double the discipline! • C. US Stocks: Somewhat… spontaneous. Think “stock market roulette” 🎯 • D. CDSL: My heavyweight pick – not SIP-based, but I throw in money here and there like confetti.

Now, some burning questions: 1. What’s working, and what should I give the boot? 👢 2. Should I ditch Invesco MF and put that money into 7 handpicked US stocks instead? 💡 3. Is CDSL still a solid move? I like it, but the amounts I invest are random—should I plan this better? 4. For Nippon and Parag Parikh, should I keep both ₹5K SIPs, or combine them into one ₹10K mega-SIP for the next 15 years?

Thanks a ton in advance! Open to all wisdom, advice, and “aha” moments! 🙏📈