Is Nishchit Aayush Plan all fuss?

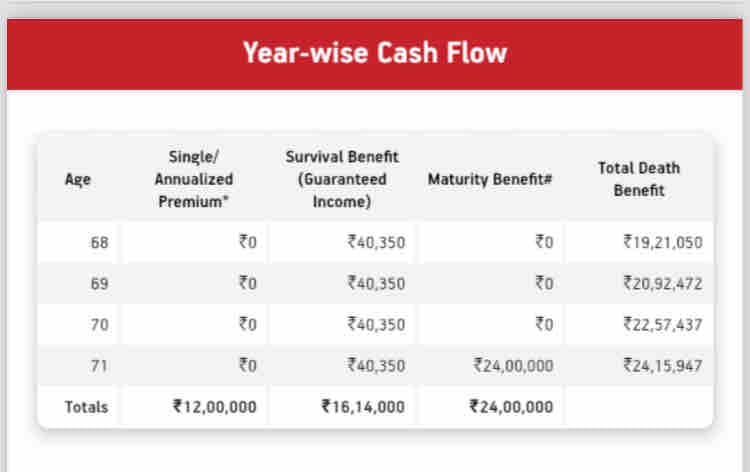

The bank tried selling me the plan. 1L investment for first 12 years ₹40k return every year for 40 years.

Also some death benefit starting from 10L upto 24L depending on maturity. I don’t understand the math behind it, but if we include inflation, this is not all that useful, right?

https://www.idfcfirstbank.com/personal-banking/insurance/absl-nishchit-aayush-plan

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

It's the worst plan for a customer. Effective interest rate offered is approx 1% per annum. Better to take a term insurance which would approximately cost 10k and invest balance in mutual funds. Assuming 12% CAGR in MF you would be having corpus of around 17cr at end of 52nd year. Assuming 6% inflation it would be equivalent to around 80 lakhs today.

💯🙌🏼

People lack financial literacy. My neighbour became an agent after retirement and started selling this too everyone in our building. His family has also started investing in it.

Tried really hard to convince me. There are many videos on YT which explains the math and how this is a terrible investment option; which I shared with him. But they were not convinced.

True man