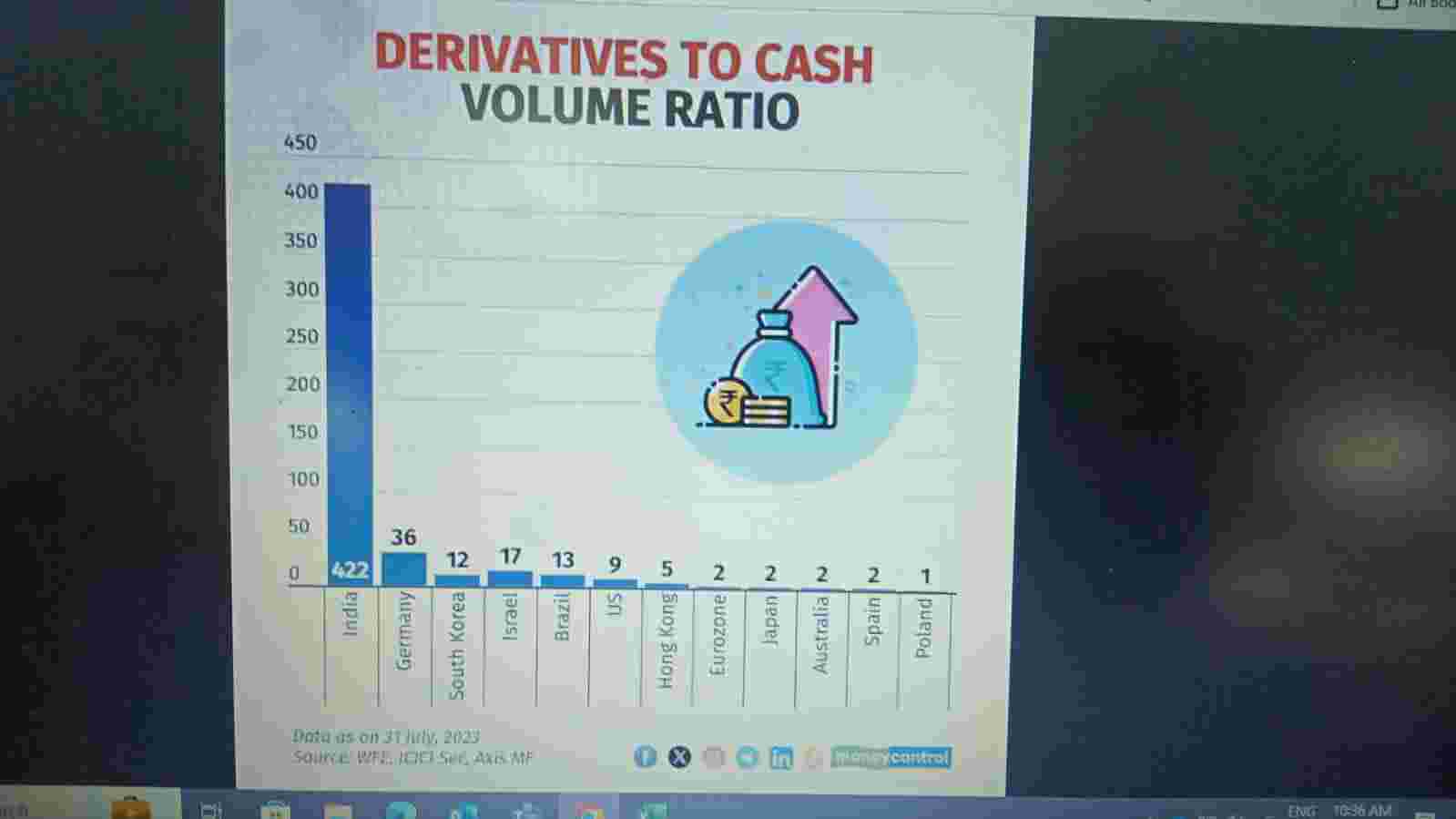

Insane Derivatives to Cash Volume Ratio

This seems extremely high for a country like India.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Probably due to extremely low denominator effect? 🧐

Even if it is, the point is people are dabbling in derivatives way more than cash.

Volumes can be high if there is high trading activity, which can be true due to retail investors and heavy participation.

What we shud check is the Open interest to avg daily Cash trading volumes.

So many people that have no experience start with the option and start selling courses and call themselves a trader and lure gullible people.

Entry to the barrier is 0. Just a demat and few thousands and you can start buying options.

Get rich quick mindset since options can move 10-50% in 1,2 sessions.

Fake profit screenshots that are moving around are nothing but a trap to sell courses, screeners, algos. No wonder less than 1% people beat Nifty returns.

*Barrier to entry lol

This doesn't look good, does it? But what are some of the more direct implications of this on the general state of the markets?

I thought this was true for the entire world but apparently I was wrong.

Could there be any simple explanation for this? Just low barrier entry doesn't seem to be enough for such a huge anomalous difference.