Income tax notice due to TCS not filling TDS correctly

I have received tax notice from it department. It seems TCS has filled the TDS for q4 incorrectly. What needs to be done for this. Should I contact HR or raise a GHD ticket? Please help

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Same issue like everyone. My guess is the issue is not by TCS but by income tax Dept. The form 26AS is showing the correct tax deducted and that means the amount is credited to IT. May due to some issues in their application, the 4th quarter amount is not accounted in their application.

We have to raise with TCS as well as IT. One more observation the amount claim by IT is not reflecting in the website yet. It is only the email triggered to individuals to pay the difference. Believe they will correct at their end soon.

Is it the same for all TCS employees?

Looking at this post, looks like another major blunder from TCS side... Now they want us to pay more irrelevant tax as well. Such a shit and disgusting organisation.

And yes, seems most employees impacted with same issue. My suggestion kindly raise a rejection / dispute so that the IT dept understand the blunder for TCS employees only and necessary notice is sent to our organisation from IT dept.

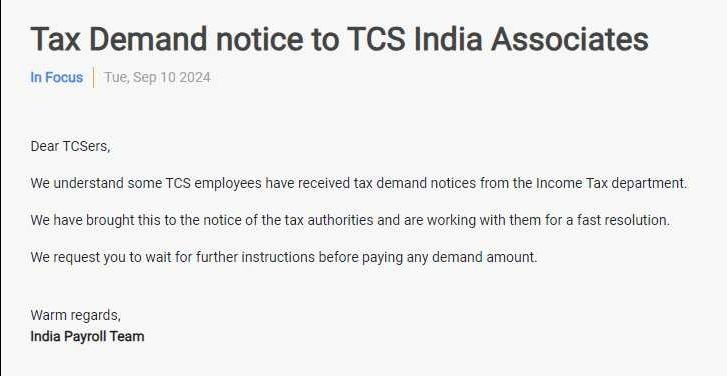

just saw some explanation on this on ultimatix. They're asking us to not pay any amount as of now and wait for further instructions..

My form 26 AS has correct TDS which I have filed during return but yet I got less refund due to Form 26AS contains partial amount of TDS/TCS with respect to the TAN mentioned in schedule TDS 1/ TDS 2/ TCS

I too got this issue, I had updated manually while filling ITR but yesterday I too got the notice from income tax department including some more interest to be paid. I don't know how to proceed on this, bt I have raised a GHD ticket for this. Try raising tickets in ultimatix, so that we can get a solution to this.

Yeah same.. Amount shown in Form 26AS is only for the first 3 quarters... The TDS for Q4 isn't added there... I updated it manually in the ITR, but now got ITR notice... There is option to raise a dispute for incorrect TDS also, but I am not sure how long it will take and how tax dept will do the verification?

How to handle this