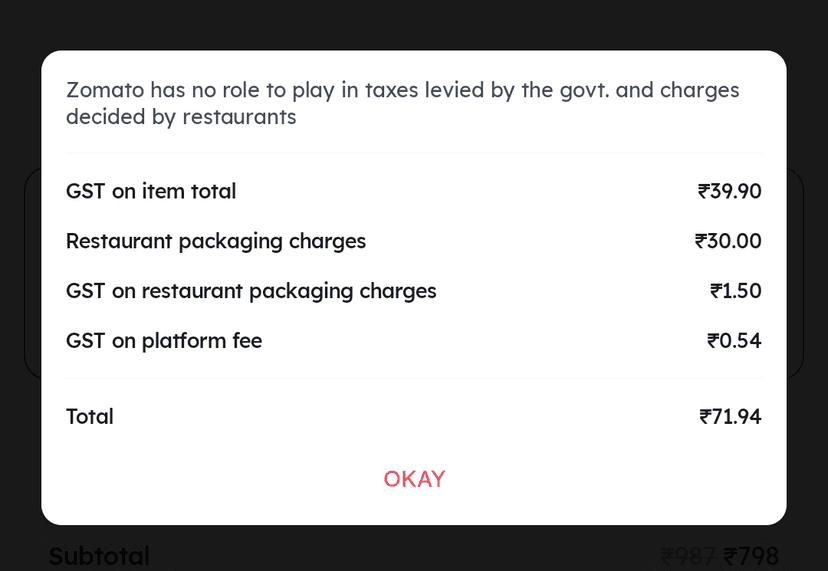

Inclusive GST kyu nahi kar sakte

Khane part GST Packaging par GST Platform fee par bhi GST GST par GST laga do ab

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

I have never seen a restaurant ask for packaging fees when we get food packed in person. Also restaurant menu prices are higher on Swiggy and Zomato.

Yeah some restaurants bump up the listing prices by 15-20% to cover the take rate that these companies charge

A restaurant near my house charges rs 250 for 10 pieces of chicken lollypop when they deliver.

On Swiggy the same restaurant charges rs 250 for 6 pieces of chicken lollypop plus GST + delivery charge + packing charges 😩

Noticed this for multiple restaurants. I mostly check the menu on Swiggy and deliver directly from these stores. Delivery is also quicker. Swiggy and Zomato delivery takes minimum of 40-50 mins, even when restaurant is within a km distance.

That’s an insane amount of tax

There is a chance of misinterpretation. People Might think GST I charged higher than actuals.