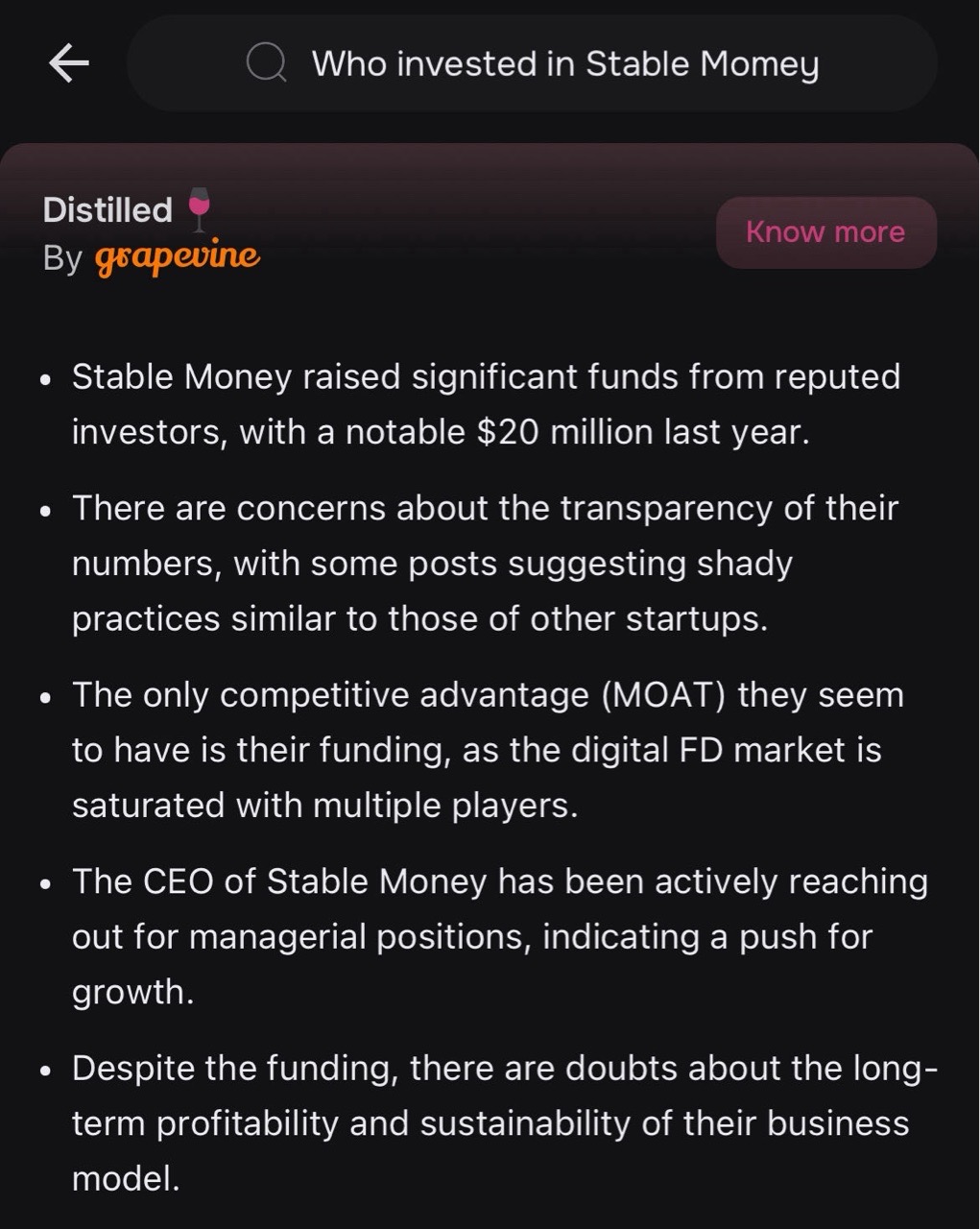

I'm Saurabh Jain, Co-Founder & CEO at Stable Money. Ask me anything!

Hi Grapevine,

I'm Saurabh, currently building Stable Money, India’s largest platform for fixed return investments.

I'd love to chat with you folks about my journey in building Stable Money, my thoughts on fintech and financial services, organization building, amongst other things.

Ask me anything, I'll be back at 7 PM and begin answering! :)

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Hi Saurabh,

Thanks for doing this. As somebody in their 20s who invests in mutual funds and stocks primarily, what’s a reason for me to move to FDs? And if I do, why Stable Money as the medium?

Thanks in advance :)

@AlphaGrindset Ah, 20! I feel so old, man. Before discussing anything about FDs, I just want to say - don't play it safe, go out and build something. This is a great age to start something. I wish someone had told me this.

On FDs - You need to have a balanced portfolio. Don't put all the eggs in one basket. Your emergency fund, which is liquid, has to be in FDs. Why Stable money? Because like your bio, we are also a series A company, haha. Jokes apart, we will offer you the highest FD rates and the best CX. Trust us once :)(

when we will bring the More stable banks other than small banks? and what is the plan to bring the bonds andother investment options

Hey Saurabh, great to have you here on GV!

How does Stable Money ensure that it remains customer-focused rather than purely sales-driven, especially in a competitive fintech landscape?

@EmbarrassedDiversity Diversity We talk to our customers every day! I mean it. We are the only ones who offer full-time call support to address any and all customer inquiries, including those from new customers. Trust me, that's not easy to do. Even at our small scale, we handle over 700 calls every day. And it's not just the support team – everyone on the team is on the phone with someone at some point, including me. I'm in direct contact with 10% of our users. This keeps us grounded and in touch with reality. By listening to our customers, we have been able to create some great features. That's hard to keep up going forward but we will stop that last.

@SaurabhJain love this!!

Why should one invest in FDs/Bonds while investing in NIFTY50 gives me better returns while being practically risk free?

@FelineHunting Hunting Great choice, man! I hope you are investing in Nifty 50, as it is the cheapest option. However, investing there does not guarantee that you will always come out positive when you need money urgently. So, where do you keep money for emergencies? Nifty has yielded 12% over a long period, but there have been years when the returns were much lower.

How is nifty 50 risk free? The index gave around 4% returns in 2022.

Hey Saurabh I am @salt

-

What are your thoughts on usesrs on grapevine thinking that the only sustainable advantage Stable Money has is the insane amount of funding you have raised? Massive Props on that.

-

How do you plan to succeed in this sector where even greatly funded apps have faltered hard? What’s the core need you are able to service and what’s your ethos around solving for it?

@salt Hey, tough one, but let's start with this one!

- We don't have insane funding. Come on :) Look at Zepto and others. You will be surprised at how much money is still in the bank, and we haven't spent. I believe our advantage is how customer-obsessed we are because we feel we need to work really hard to make FD look cool

- Yes, many who tried FD have failed, but one core difference is FD is our hero product and not a cross-sell idea. And we are the only ones doing that which works greatly in our favour. This helps us continuously improve on the CX for FD booking where others lag.

Personal opinion: I think the biggest differentiator is not selling, rather they are catering to the emotion of "Fear" which is overindexed in Indians, especially pre 1991 folks. Compared to other companies who are selling "Greed" to the youth, they want to continuously cater to the risk averse component of investment in everyone's life, including their parents.

Hence, you go all in on LinkedIn which drives your acquisitions on the basis of your personal brand, @SaurabhJain .

Seeing company's growth from last year. How can someone join the stable money team?

++

@AnguishedRack, Let's talk, man! No positions are open right now, but we are always (always) looking for hungry folks who are here to prove something to themselves (or others). DM me on Linkedin??

Hi Saurabh, been following your journey for long enough :)

What motivated your shift from a tech-driven role at Swiggy to leading a financial entity like Navi Mutual Fund, and what challenges did you face during this transition?

@DullServitude Hey, I need some help with Gupshup. Hope you can help. haha :)

I never told this to anyone, but just for you - I would have moved for any role, any domain just to work with Sachin Bansal. It just happened to be that he was working on Navi. No thoughts, deep thinking or strategy before moving. :)

I found it easy because I had no baggage of what works, regulations, etc. So was freely working on ideas - Some failed but some worked amazingly well. E.g. starting low cost index fund as a strategy.

Hi Saurabh, I have invested on Stable money and a member of your top 1 %. I joined it as a part of my product research and eventually hooked due to easy U/UXI. My question is “ I can see the name of banks I have never heard before on your app, I am sure they are insured by govt upto 5 lakhs - how will stable money help its users who are from tier 3/4 in case the bank stumbles. I am sure it will take time, are you planning to do something different here? Coz when I was researching in Tier 1, I found people want to trust your brand and not the bank and eventually this will drill down to tier 3/4 as well.

Also, from the mar

Also the features you offer in top 1% club is just for the sake of it, again good UI/UX though. I think a lot better can be done there without investing much. Please ask your product team to think - amazing opportunities there and pls don’t give free masterclass access, market is flooded with such marketing centric masterclasses, the fad of online classes is over.

Hey Saurabh, what does my net worth/balance need to be for me to use Stable Money? Is there a minimum?

@SentinelPrime You just need to show some love to us and I am happy to fund your first FD :) Honestly!

But technical answer is 1000! You can book your 1000 FD on our platform (Ujjivan Bank) and get started.

Hi Saurabh, welcome to GV :)

Given the perception of FDs as low-return investments, how do you convince investors of their value, especially in a high-interest environment?

I literally beg, haha! Honest answer, there are 25cr FDs. It needs no convincing. Just that your and my primary circle doesn’t do it more often but India runs on FD. And I run behind them :-)