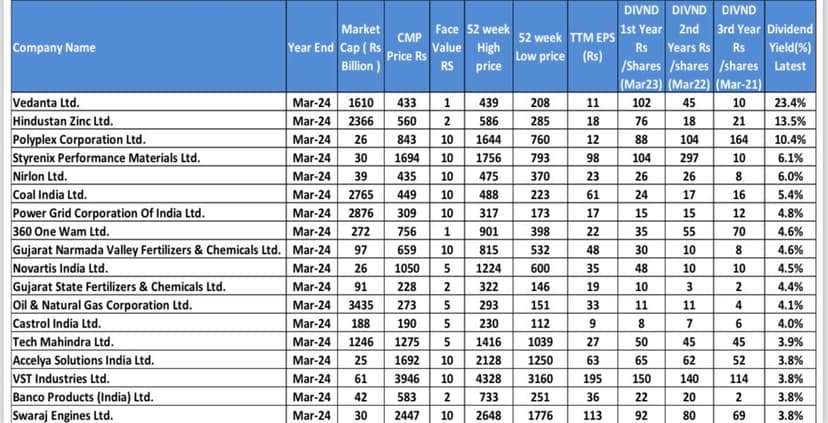

High Dividend Paying Stocks List

Average of below stocks can beat FD.

Any other recommendations except below (PFA) ?

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

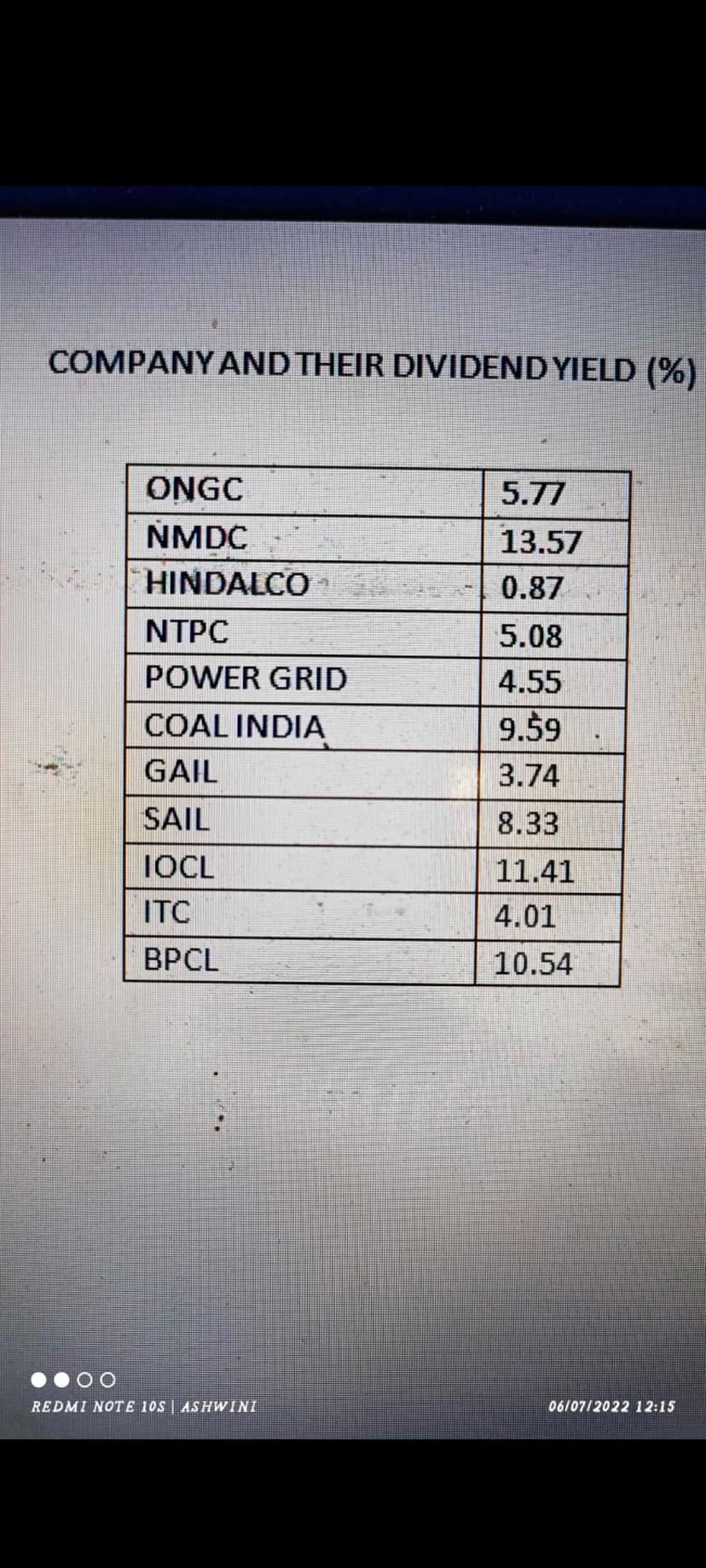

As I mentioned in another post, investing in the energy and power sector will never let you down in any fu**ing century.

By the way, Adani Green is overpriced now, so stay away from that.

As for Suzlon, please wait for the next 2-3 months. According to my knowledge, Suzlon is in talks with some big investors, so if that materializes, there will be a huge jump.

Next financial year, NTPC Renewable is going to launch its IPO. Just don't lose the opportunity, and if you get it, don't sell for the next 10 years.

Keep an eye on NHPC and SJVN.

By the way, these are not recommendations, just a little information.

Nice

Outdated data, looks several years old. Coal india dividend yield is not 9.59% anymore. Market is overvalued, there are no dividend yield stocks that can beat FD right now

+vedanta (debatable btw)

Someone has already spoken what's on my mind, these companies can choose not to pay didividend. Would be much preferable if they can put those profits back in to make more earnings. Are you solely choosing to invest them for dividends?

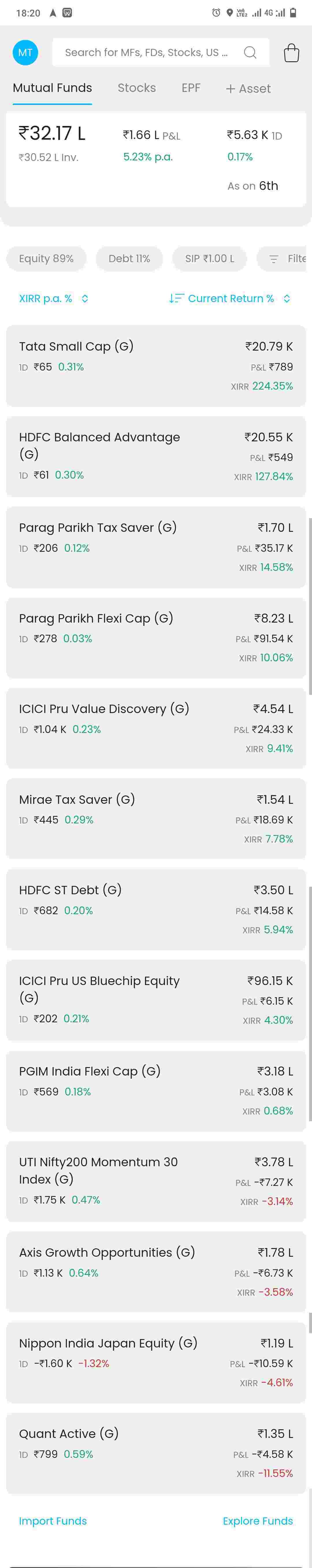

Investment diversification

Looking for suggestions on where to invest and what are the best options in that category

For example, Canara Robeco Bluechip Fund for equity investments

Looking for suggestions on Mutual Funds, Bonds, PPF, EPF, FD, or any other types ...

Investment advice

I’m ready to invest 1L per month. My investment breakup is 30% (₹30000)in stocks (mostly targeting on dividend yield) 20% (₹20000)in Gold 50% (₹50000)in MF -> 30% (₹15000)of this in large cap -> 20% (₹10000)of this in Index fund ...