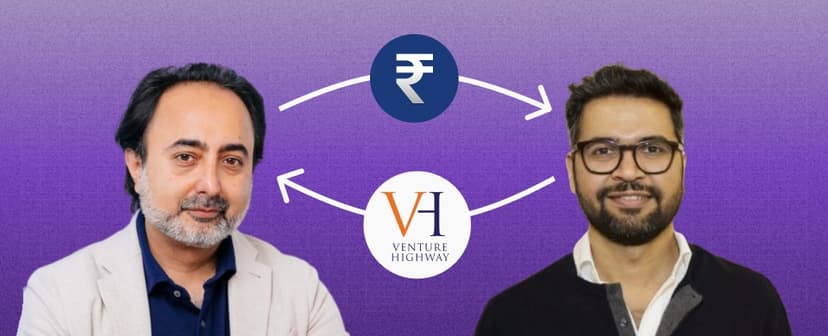

General Catalyst's Venture Highway Acquisition: A Strategic Play for India 🇮🇳

In a landmark deal, Silicon Valley powerhouse General Catalyst has acquired Venture Highway, a seed-stage investment firm with a track record of backing winners like Meesho and Mobile Premier League.

The Deal:

- Rare instance of consolidation in the Indian VC market

- VH to be rebranded as General Catalyst India

- GC plans to invest $500 million to $1 billion in India over the next three years

- Acquisition driven by desire to build strong local team and tap into local LP network

But the move also raises important questions. Will this trigger a wave of consolidation in the Indian VC market? Will other global firms follow suit and snap up local players to gain a foothold in the country? And how will this influx of foreign capital shape the trajectory of India's startup ecosystem?

As the dust settles on this landmark deal, one thing is clear: India's startup scene is entering a new era, one where local innovation and global capital are increasingly intertwined. Always long on India 🇮🇳

Image Credits: The Arc

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Isn’t this the one where Aviral Bhatnagar used to be a part of before?

Guys this came in Grapevine a long long time ago. Big win for this community

General Catalyst, a prominent US-based venture capital firm, is in talks to acquire Indian VC firm Venture Highway. This move is part of General Catalyst's broader strategy to expand its presence in India's burgeoning tech startup ecosystem oai_citation:1,"General Catalyst's US-India Acquisition Talks: Expanding Venture Highway" | FunderLyst oai_citation:2,"Accelerating India's Growth: General Catalyst Considers Venture Highway Acquisition" | FunderLyst oai_citation:3,General Catalyst considers acquiring Venture Highway to strengthen its India focus | Startup Story.

Deal Details and Reasoning

-

Strategic Expansion: General Catalyst aims to leverage Venture Highway's local expertise and portfolio, which includes successful startups like Meesho, Cred, MPL, and ShareChat. This acquisition is seen as a strategic step to strengthen its foothold in India, a market noted for its rapidly growing startup scene oai_citation:4,"Accelerating India's Growth: General Catalyst Considers Venture Highway Acquisition" | FunderLyst oai_citation:5,General Catalyst considers acquiring Venture Highway to strengthen its India focus | Startup Story.

-

Operational Structure: Post-acquisition, Venture Highway would likely continue operating as an investing arm of General Catalyst in India. This setup allows General Catalyst to tap into early-stage investment opportunities while benefiting from Venture Highway's established network and market insights oai_citation:6,General Catalyst considers acquiring Venture Highway to strengthen its India focus | Startup Story.

-

Previous Acquisitions: This potential acquisition follows General Catalyst's acquisition of Berlin-based VC firm La Famiglia in October 2023, indicating a pattern of acquiring country-specific VCs to enhance its global reach oai_citation:7,"Accelerating India's Growth: General Catalyst Considers Venture Highway Acquisition" | FunderLyst.

Is This New for India?

Global-local collaboration in the venture capital space isn't entirely new for India. Other notable examples include:

- Sequoia Capital India: A subsidiary of the US-based Sequoia Capital, it has been actively investing in Indian startups for years.

- Accel Partners India: Another example of a global VC firm with a strong local presence, investing in prominent Indian startups like Flipkart and Swiggy oai_citation:8,"Accelerating India's Growth: General Catalyst Considers Venture Highway Acquisition" | FunderLyst oai_citation:9,General Catalyst considers acquiring Venture Highway to strengthen its India focus | Startup Story.

Other VC Consolidation Deals

- Sequoia Capital's Global Fund: Sequoia Capital's restructuring to form a unified global fund in 2022 is a notable example. This reorganization aimed to create a seamless global investment strategy, enhancing its ability to support startups worldwide oai_citation:10,General Catalyst considers acquiring Venture Highway to strengthen its India focus | Startup Story.

- SoftBank's Vision Fund: SoftBank's Vision Fund, although not a traditional VC firm, has made significant global investments, including in India, demonstrating the trend of large funds making strategic investments across multiple geographies oai_citation:11,"Accelerating India's Growth: General Catalyst Considers Venture Highway Acquisition" | FunderLyst.

Way Forward

For General Catalyst, acquiring Venture Highway would solidify its strategy of building a strong local presence in key global markets. The focus on India aligns with the country's growing importance as a startup hub, driven by a large youth population, increasing internet penetration, and supportive government policies. This acquisition, if successful, would enhance General Catalyst's ability to identify and invest in promising early-stage startups in India, leveraging Venture Highway's local expertise and existing portfolio.

Overall, this potential acquisition is a reflection of the increasing globalization of venture capital, where firms seek to combine global resources with local insights to drive growth and innovation in dynamic markets like India oai_citation:12,"General Catalyst's US-India Acquisition Talks: Expanding Venture Highway" | FunderLyst oai_citation:13,"Accelerating India's Growth: General Catalyst Considers Venture Highway Acquisition" | FunderLyst oai_citation:14,General Catalyst considers acquiring Venture Highway to strengthen its India focus | Startup Story.