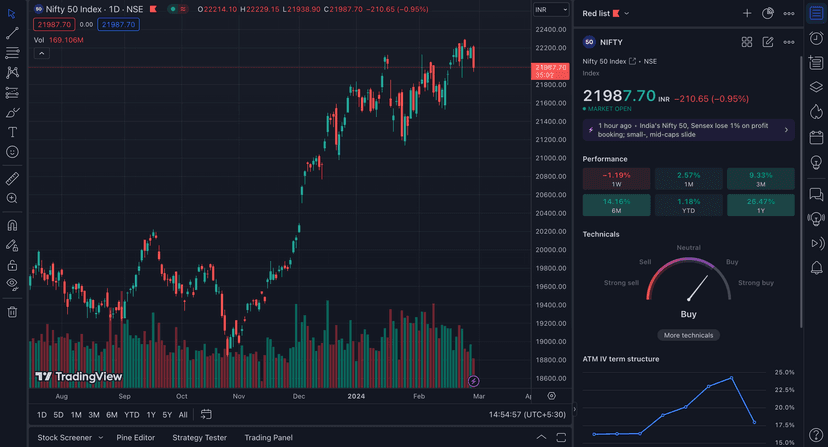

🚨 Are you guys investing more or not?

People say you can't time the market but I am curious what is the junta on Grapevine thinking about investing in the current times.

Also where do I invest now? I have some 1L to invest that would not impact my current liquidity.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑I am betting big on investing in Hang Seng Tech ETF (Tencent, Alibaba, Baidu, JD etc) at this price.... Very undervalued and it will be China's weapon against USA in race for AGI

I’m nobiie tbh. But from what I’ve heard, I’ve been told to keep my puny little amount as of now, because of election people unneccessarily pumping the amount in market or something. And do it after election? Untill then only observe? What is the logic behind this?

For how long you want to invest?

10 year: I would invest in Petrol Pumps. 5 year: I would invest in Banks which give shorter loans or are EMI enabler.

I don’t get the idea of petrol pump can you explain ?

We all know EVs are coming and you need charging infra for that and the first adoption for that will be in metros and Tier 1 cities. Spaces are very limited so pumps are the existing option that will be utilised. That's why you see all the EV companies having battery swapping partnering with such companies.

Buying Gold ETFs to park the money before rate cuts. Stopped all SIPs, rejigged the portfolio- 65% large cap rest mid and small cap (direct equities: 75% large cap)

Highest allocation- Banks (value), Infra (growth) and Chemicals (value)

Recurring deposit started for 10k a month so get around 50-60k in June before the rate cut

Have bought around 3L of Adani stocks to be sold post elections

No new cash addition, just moving the portfolio around (increasingly becoming difficult due to size of portfolio)

Names I am picking irrespective of market sentiment. Am a high risk appetite investor (after my share of tesearch)

-Gensol -Dynacons (DSSL) -DCXSystems -Agarwal Ind

-ZenTech -Edelweiss (long haul) -SircaPaints

Will enter TataTech around 980 [holding a few IPO alloted lots], Droneacharya and Sealmaticat the right lrice

Wait it out @salt . If you wanna get into trading then you have numerous opportunities, but if you wanna invest wait it out for sometime. Being on Cash is also a position in itself.