[Analysis] What do you think about market efficiency versus seeking alpha in trading?

Have been analyzing the Broader US markets for the last couple of weeks.

Efficient Market Hypothesis seems to suggest that the prices of financial instruments reflect all available market information. Hence, investors cannot have an meaningful edge by analysing the stocks and adopting different market timing strategies.

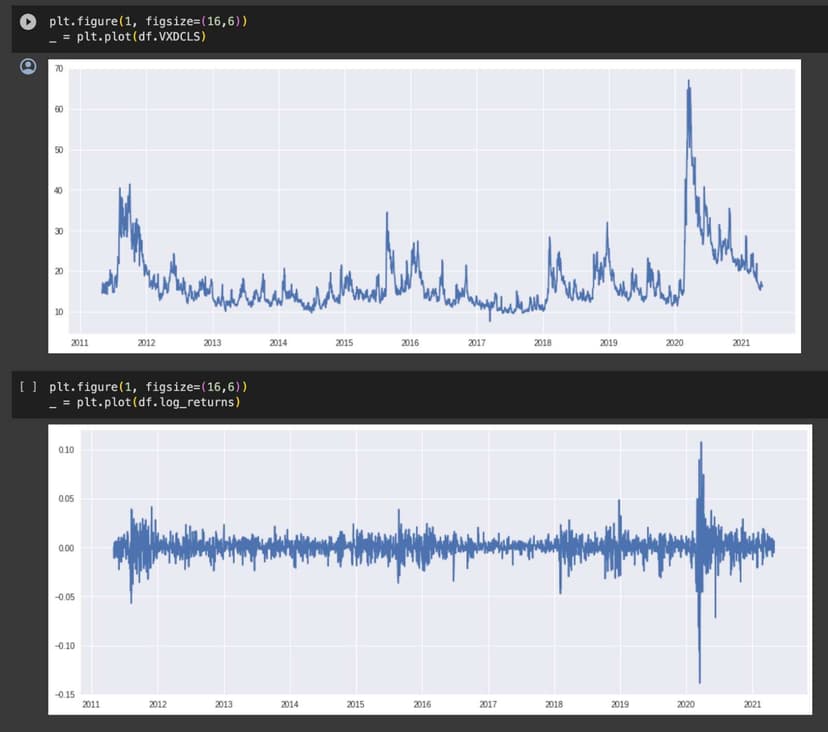

The VIX expresses the inherent volatility of the market and is a real time index that derives expected volatility in the index by averaging the weighted prices of out of the money put and call options. The value of the VIX increases when the markets are falling, this also indicates an increase in the expectation of upcoming volatility and the investor’s fear in the markets. Also to be noted that the index value cools off when the markets respond positively and advance. The volatility declines and investor fear declines.

However, there have always existed market inefficiencies that can be exploited to make money and I'm just wondering if anyone has done something similar?

My current modelling seems to suggest that there is some minor alpha that is available when you trade on VIX data. It is just had to gauge the directionality of the movement. Usually, a net 5% movement in 2 trading days is significant enough to take a position.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Me buying put options on 5% positive VIX movement and losing all money 🥲

Jokes apart. This works for Indian market too right? Our volatility index usually hovers in between 16-21 if I ain't wrong.

Interesting. Good info

@Enolagay Thanks

Bhai kuch samajh hi ni aa rha poore post me. Good for you OP

Jab samjh na aae toh ask ChatGPT to explain it to you like you are 5.

What ChatGPT said xD:

Alright, imagine you have a big toy store, and everyone in the neighborhood wants to buy and sell toys there. Now, some people think that the prices of toys always show how much they are really worth. This is like saying that if a toy is super popular, everyone will know, and its price will already be just right. That's what they call "Efficient Market Hypothesis."

But some clever people keep an eye on a special toy, let's call it the "VIX toy." This toy helps them guess how wild and crazy the buying and selling might get. When people are worried about the toys (like when the prices are falling), the VIX toy's price goes up. When things are good and everyone is happy, the VIX toy's price goes down.

Now, even though some say everything is already figured out, there are still some tricks you can play to make a little extra. Like when the VIX toy jumps around a lot (moves 5% in 2 days), you might decide to do something cool with your toys.

So, it's like some people think everything is fair and square, but others are like toy detectives, finding little secrets to make some extra fun. Just remember, it's not always easy to know which way the toys will go!

Vix is farzi 90% of the times since option trading became popular, more so after covid. Only spikes very later when fear is rising, no spikes after covid, we had 2 wars

I believe everything can be a great strategy and not at the same time... depending on how you use it.....I believe the occurrence of alpha over past data is in itself a random pattern and no such strategy exists which can make you money forever...I suggest guess and ishahallah... Most of the time it's either going to go up or down

My 2 cents about timing the vix and trades - they are more often than not tied to news events and major shifts.

Small example - people have bots running that read elon's tweets that instantly buy dogecoin every time he mentions it on X, and sell at a profit. Pretty sure there are other people being tracked online in a similar fashion.

The day Israel Palestine shit broke out was a good day to long oil. Open AI lafda was a good day to short MSFT.

Fed hiking rates and CPI numbers are another event to watch out for. Markets react every time to such events, easily 2-5% depending on the gravity of the situation.

Very difficult to time it though, have to have smart bots that can take the right trade at the right time. Just mentions of keywords isn't usually enough either, positive or negative sentiment also matters.

I've tried taking manual trades in the heat of the moment, was extremely difficult. Needs active hedging quite often as well, along with staying online 24/7 and barely getting any sleep.

I didn't understand half your post tbh, I'm just a self taught trader and ex crypto degen who managed to make money over the years. Open to learning more/proven wrong.