Reduce loan EMI duration

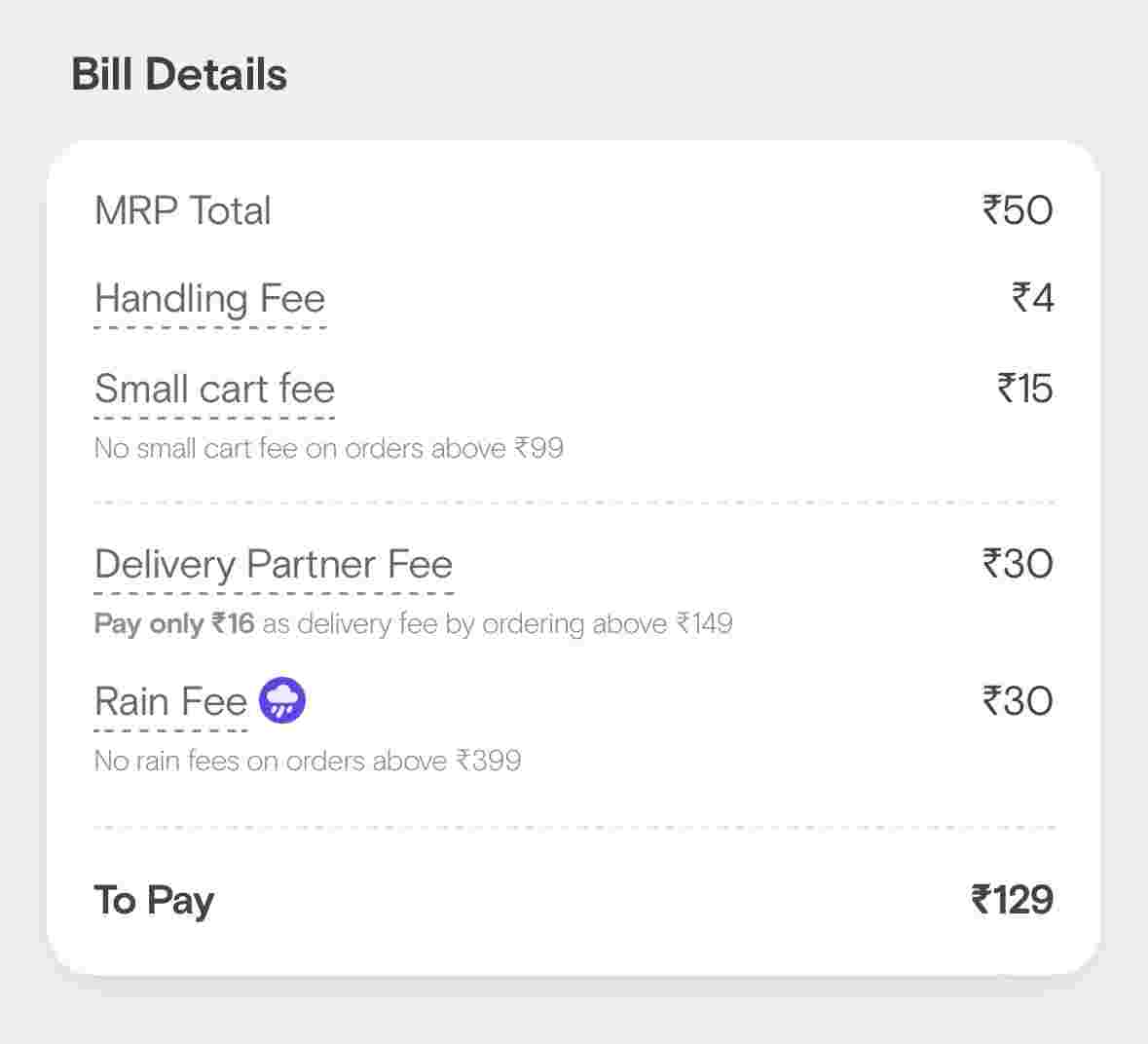

Hey all, I have noticed that there are a lot of cash backs and rewards platform which make us spend on other products rather than being useself to clear of my loan or just receive it back in my bank.

I’m solving this.

We help reduce...