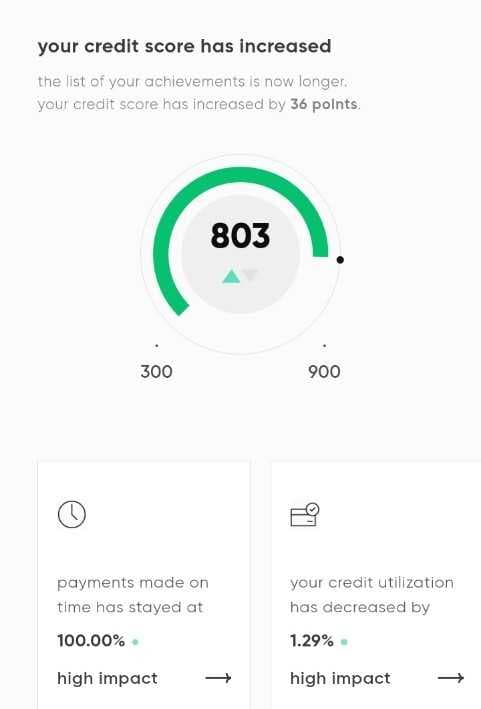

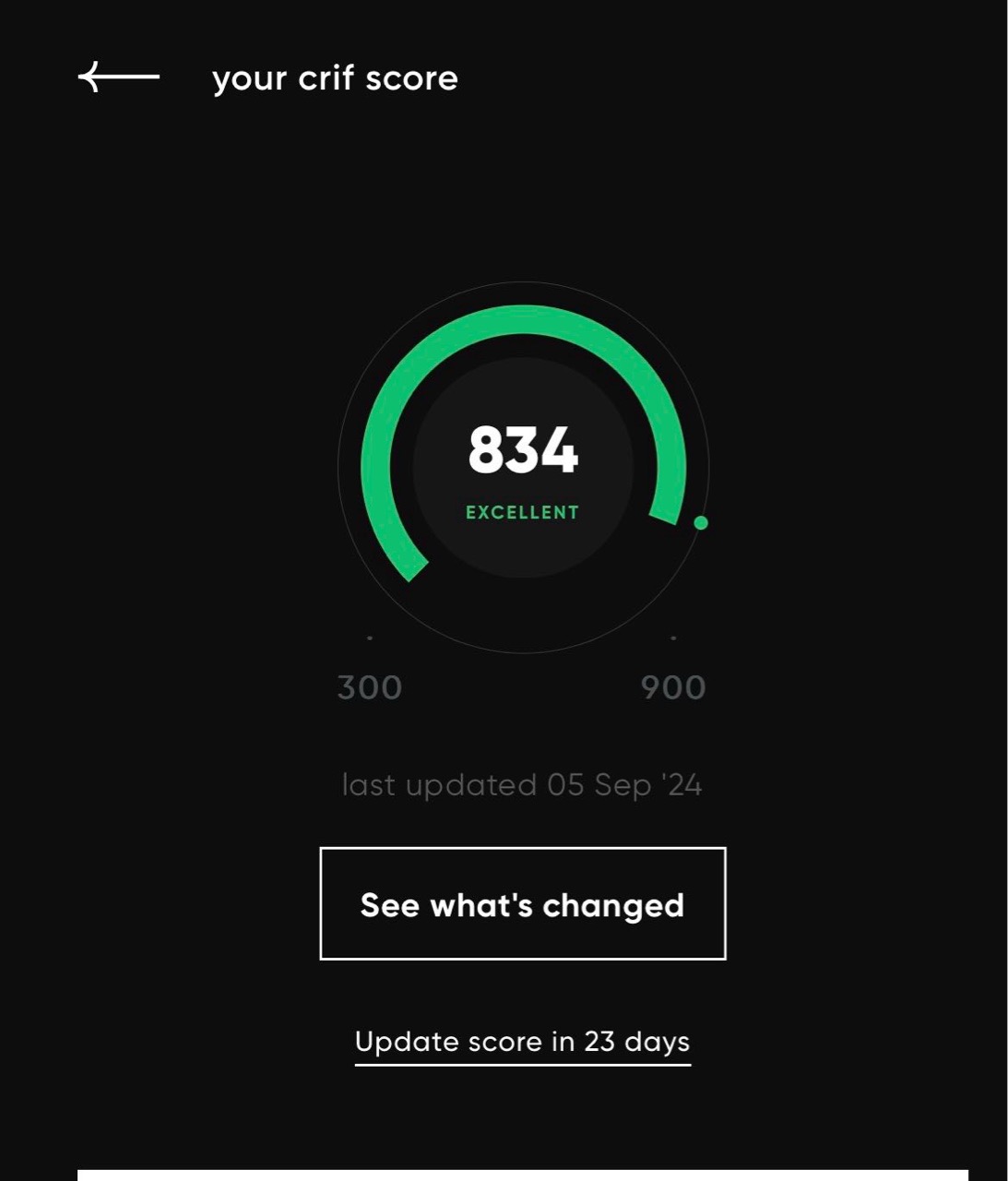

803 Credit Score

I hit 803 Credit Score. Key learning:

- Utilizes 5 - 10% of credit limit.

- Never missed any bill payment and paid on fixed dates 1 - 3 of every month.

- No active loan, privious loan payments are on time.

- Make a increase in credit limit 2 times in a duration of 2 years

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Are there any other benefits of a high credit score other than easier loan approval?

Negotiation in loan interest rate and high end credit cards approval.

Higher loan amount with lower interest rates, easily get the premium credit card for your self and family.

Great 👍

😎

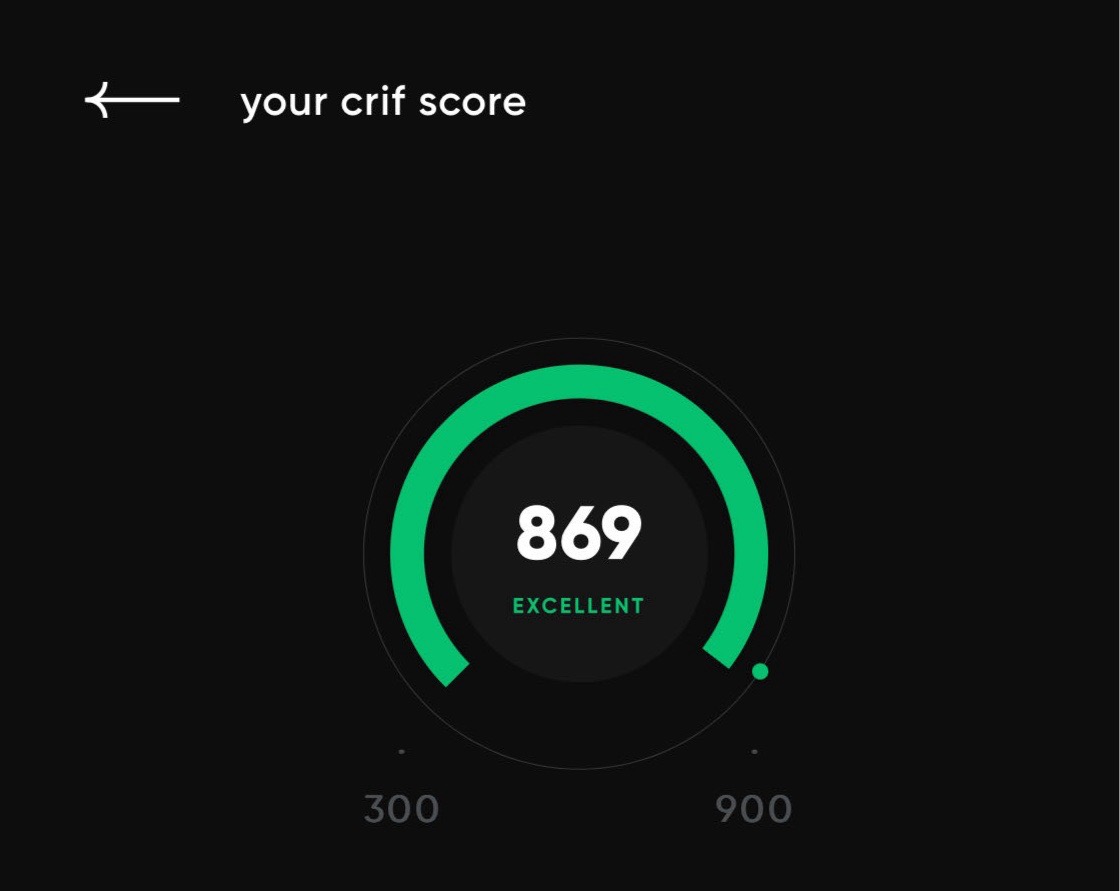

Isn’t this CRIF score and not CIBIL ?

I thought with these scores everyone can easily be around 800+

Yeah I've barely used cards and loans in my life, still had 790-800 credit score

CRIF and CIBIL both are different companies to calculate the credit score, but this is the CIBIL score as CRED use to show the credit score but both are same.

Kids😂

Great 👍

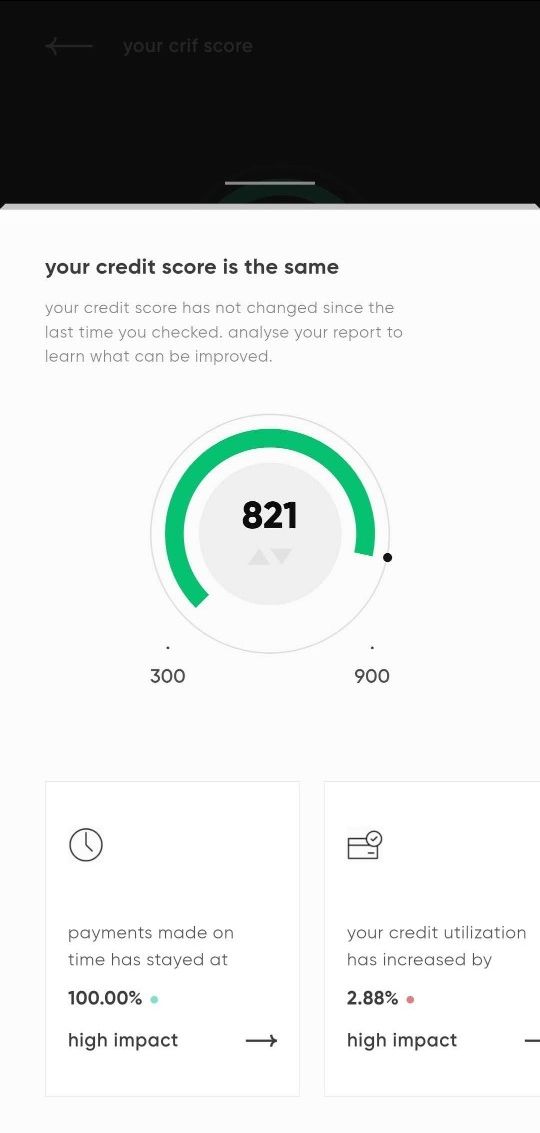

I've 805 in Cibil and 820 in Experian. I've a credit card, a housing loan and a loan (top-up on housing) for interiors. All are active, no payments missed. I do use all the limit on my credit card though, but I'll pay back twice a month instead of monthly.